TL;DR

- Privacy coins like Zcash surge over 20% as the broader market falls.

- Zcash futures trading volume hits a historic $20 billion in a single day.

- Privacy coins now account for a record 6% of all crypto trading.

Privacy coins are recording substantial gains amid a generally declining broader market. An analysis report from the analytics firm CryptoQuant details price increases between 20% and 700% for assets like Zcash and Dash. This movement contrasts with a 1.5% drop in the overall crypto sector’s value.

Trading volumes for these assets have reached unprecedented levels. As we previously reported Zcash managed to reposition itself among the top twenty cryptocurrencies. Its price surpassed six hundred dollars, a level not seen in almost seven years.

Trading Volumes Set New Historical Records

The futures trading volume for Zcash reached twenty billion dollars. Dash recorded an increase of nearly 50% in a single day, reaching its highest value since early 2022. Its trading volume reached 5.4 billion dollars.

Monero reported a futures volume of 461.8 million dollars. Verge and Secret Network posted figures of 403.98 million and 228.35 million, respectively. The current figures surpass all previous peaks of interest in these coins.

The market capitalization for the privacy coin sector climbed to 41.7 billion dollars. This figure represents a 41% increase on a single day in November.

Retail traders are showing renewed interest

CryptoQuant’s data indicates a sharp rebound in activity from this segment. Futures trading for Zcash and Dash experienced considerable jumps. This trend suggests a return of the fear of missing out.

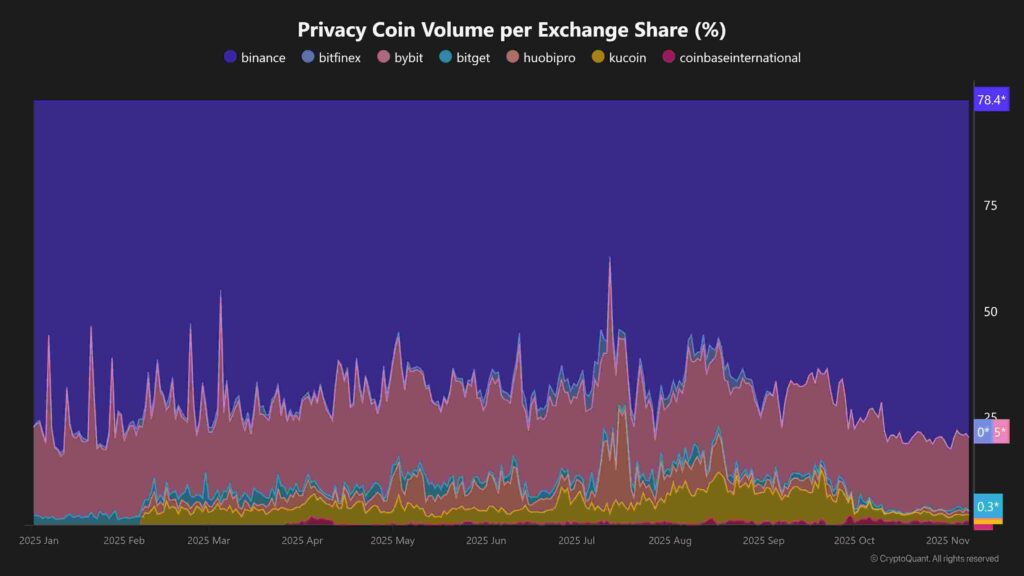

The Binance platform concentrates approximately 78% of all privacy coin trading volume. Bybit occupies second place, with a 17% share.

Privacy coins now constitute 6% of the total crypto trading volume. This is the highest share recorded in history. The figure implies that one in every sixteen transactions involves a privacy-focused token.

As of November 2025, the top privacy tokens by market capitalization are dominated by projects emphasizing anonymity, scalability, and cryptographic innovation. The leading privacy coins continue to face both technological evolution and regulatory scrutiny, especially in regions enforcing strict KYC/AML policies. Below is a current overview:

- Monero (XMR) — The largest privacy-focused cryptocurrency, valued at over $2.3 billion in market cap. It uses ring signatures, stealth addresses, and bulletproofs to ensure untraceable transactions.

- Zcash (ZEC) — Market cap around $400 million, powered by zero-knowledge proofs (zk-SNARKs) that enable shielded and transparent transactions.

- Dero (DERO) — A hybrid blockchain combining smart contracts with privacy through homomorphic encryption, with a market cap near $250 million.

- Firo (FIRO) — Formerly known as Zcoin, it integrates Lelantus protocol for full transaction privacy, holding about $90 million in market cap.

- Haven Protocol (XHV) — A fork of Monero focusing on private stable assets, currently valued around $60 million.

The privacy sector remains one of the most innovative yet controversial areas in crypto. While technological progress such as zk-proofs and privacy layers enhances user confidentiality, regulatory challenges continue to limit exchange listings and liquidity. Nonetheless, investor interest persists as data privacy becomes increasingly vital in the digital economy.