Bitcoin is once again in the spotlight as the next halving is scheduled for April-May 2024. This event, occurring approximately every four years, has historically had a significant impact on the price and market dynamics of BTC. Analysts are already speculating about what may happen to the price in the coming years.

The halving cuts in half the reward for each mined block, being an intrinsic feature of the Bitcoin protocol. It is implemented with the goal of controlling the supply and maintaining scarcity, mimicking the dynamics of supply and demand in traditional markets. Each halving reduces by half the reward granted to miners for verifying and adding new blocks to the BTC blockchain.

Historically, halving events have sparked various speculations in the community, and their impact on the cryptocurrency’s price has been noteworthy. Before the halving, there is an accumulation phase where investors seek to retain as much BTC as possible in anticipation of the supply reduction. This period is often associated with increased trading activity and a rise in the price of Bitcoin.

Phases of the Bitcoin Halving

The first phase after the halving historically leads to a bullish period. Investors who bought during the accumulation tend to enjoy significant gains as the decrease in supply combines with growing demand. However, this phase also tends to experience price corrections after the initial highs.

In previous cycles, a retracement phase followed the bullish phase, where the price of BTC tends to fall. Some analysts suggest that investors should be prepared for new local lows before the bullish market reaches its peak. This is a stage characterized by volatility and uncertainty.

After the retracement phase, a reaccumulation stage begins. In this stage, investors, disappointed by the lack of immediate results after the halving, may sell their holdings. This creates an opportunity for other investors to accumulate BTC at relatively lower prices.

Finally, the fifth phase is the most anticipated: the parabolic bullish trend. In this period, strong demand outpaces supply, causing the price of Bitcoin to grow rapidly and reach new historical highs. It is important to note that, although past cycles can provide guidance, future behavior will depend on market conditions at each moment.

5 Phases of The Bitcoin Halving

1. Pre-Halving period

If a deeper retrace is going to occur, it will likely be over the next 140 days or so (orange)

In fact, $BTC retraced -24% in 2015 and -38% in 2019 at this same point in the cycle (i.e. ~200 days before the Halving)… pic.twitter.com/r1dAWBJXyw

— Rekt Capital (@rektcapital) October 6, 2023

Price Predictions for Bitcoin

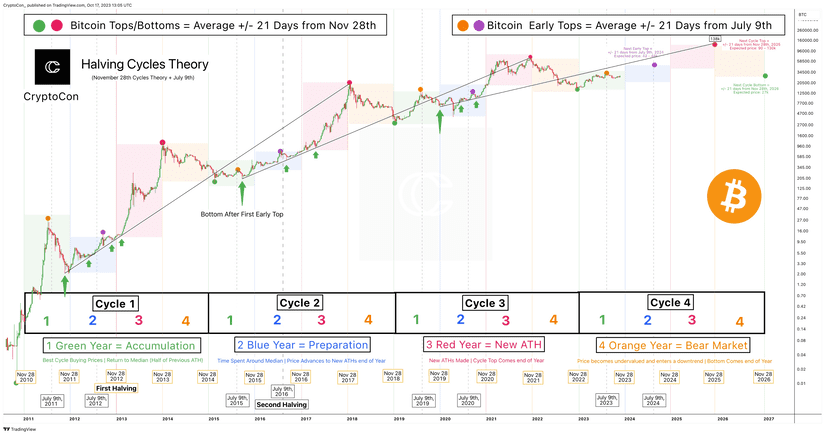

Analysts have made various projections about the possible price of BTC, with some, like CryptoCon, suggesting a two-year target of around $130,000 for BTC. This figure is not without support, as multiple forecasts converge around $130,000 by the end of 2025. Confidence in these figures is based on experiments with cycle highs, where the recurring price is around the mentioned mark.

The analysis of price cycles also plays a crucial role in these projections. There is a historical trend where “early” highs in each cycle usually occur three weeks before or after July 9, while new historical highs tend to occur three weeks after November 28. These patterns, traced through diagonal trend lines, led CryptoCon to conclude that the price could reach $130,000 in the next cycle.

Price projections for Bitcoin (BTC) post-halving indicate an optimistic outlook, with estimates converging around $130,000. However, patience remains key, as halving cycles and the possibility of retracements suggest that the path to new highs will not be without challenges and strategic opportunities for more experienced investors.