TL;DR

- Transfers above $100,000 on the XRP Ledger reached their highest level since October, despite the price pullback.

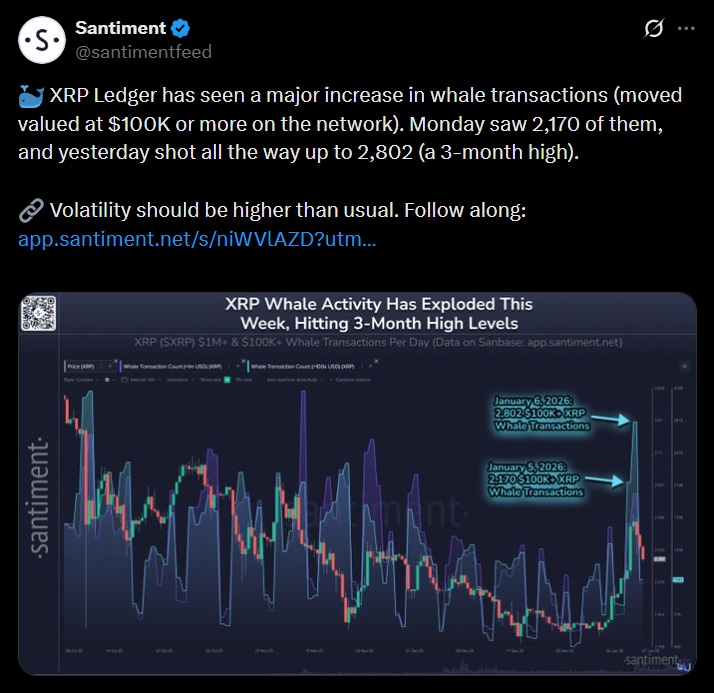

- Whale transactions climbed from 2,170 to 2,802 in 24 hours, a jump that often signals higher volatility.

- The token is trading at $2.07 after a 7.5% decline over the past session.

XRP’s on-chain activity shifted pace in the first days of the week. Transfers above $100,000 on the XRP Ledger rose to a three-month high, marking the return of whales to the network. This took place as the price corrected and the broader market showed signs of cooling.

According to Santiment, the daily number of whale-sized transactions jumped from 2,170 to 2,802 in just 24 hours, the highest reading since October. When this kind of activity accelerates, the market often enters a more erratic phase. Whales do not move capital without a reason, and their activity tends to anticipate directional changes or range expansions.

That increase contrasts with what is happening on exchanges. XRP balances on Binance fell to around 2.6 billion tokens, the lowest level since January 2024. By late 2025, the platform held roughly 3.25 billion XRP. The gap suggests concurrent withdrawals into private wallets, a pattern typically associated with asset custody rather than immediate selling.

Whale Activity Had Been Coming Off a Sharp Pullback

Whale deposits to Binance have been declining since mid-December. In November and early December, they accounted for more than 70% of total inflows. Today, they represent around 60%, while retail participation remains stable. Historically, a lower share of whale deposits reduces short-term selling pressure.

XRP: Top Trade

It is worth noting that on January 6, CNBC labeled XRP the “hottest crypto trade” of 2026. Its popularity reflects investors’ search for more aggressive percentage returns compared with Bitcoin and Ethereum, following a year-end period dominated by ETF inflows.

XRP is currently trading near $2.07 after a daily drop of 7.5%. Earlier in the week, it touched $2.40 and then pulled back alongside the broader market. Even so, it holds a weekly gain of around 12%, while the yearly performance remains slightly negative