TL;DR

- Velora replaces its PSP token with VLR, unifying its model into a single asset and aligning incentives for users and developers.

- The migration from PSP to VLR is 1:1, gasless, and offers additional rewards for early migrations.

- VLR concludes Project Miró, centralizes staking on Base, links rewards to actual revenue, and strengthens the protocol’s cross-chain infrastructure.

Velora, the cross-chain trading protocol formerly known as ParaSwap, replaces its PSP token with a new asset called VLR, aiming to consolidate its model into a single token and optimize incentives for users and developers.

The launch of VLR marks the immediate end of PSP’s utility in governance, staking, and rewards, although the token will remain transferable and usable without official support.

How Will the Migration Work?

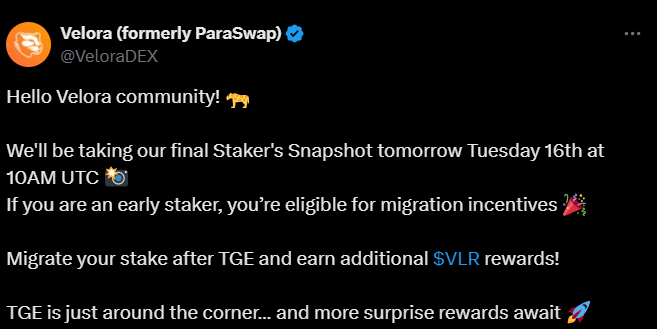

The migration from PSP to VLR occurs 1:1, gasless, through a one-click process on the Base network. This process will remain open for at least one year, and users who migrate before December 16 will receive additional VLR rewards without a vesting period. The transition requires holders of PSP, sePSP1, and sePSP2 to upgrade their tokens to maintain governance, staking, and protocol benefits.

The new model removes gas barriers and centralizes staking in a unified hub on Base. Rewards are directly linked to revenue generated by Velora instead of relying on inflationary incentives. This approach aims to align the protocol’s interests more effectively with those of the community, optimizing sustainability and long-term value for the ecosystem.

Velora Concludes Project Miró

The launch of VLR concludes Project Miró, a DAO-led initiative aimed at redesigning Velora’s brand, governance, and token model. The initiative seeks to strengthen the protocol’s infrastructure and consolidate its operational health for the future, establishing clear governance rules and increasing transparency in community decision-making.

Velora has operated since 2019 and integrates with high-profile DeFi platforms such as Aave, Morpho, and Pendle. Since its launch, the protocol has processed over $125 billion in cumulative trading volume, reaching a monthly all-time high of more than $7 billion in August. Its evolution toward a simplified model with VLR will be crucial to reinforcing its position within the DeFi ecosystem.

Velora aims to consolidate its cross-chain financial infrastructure, optimize the staking and rewards experience, and ensure incentives are aligned with actual protocol usage, laying the foundation for sustained growth and more transparent operations