TL;DR

- World Liberty Financial purchased $6 million in Vaulta’s A tokens and will include them in its Macro Strategy reserve alongside BTC, ETH, and TRON.

- Vaulta will integrate World Liberty’s USD1 stablecoin into its Web3 banking solutions to expand payment and custody options.

- WLFI token holders approved enabling secondary-market trading, which could go live in the next six to eight weeks to boost liquidity.

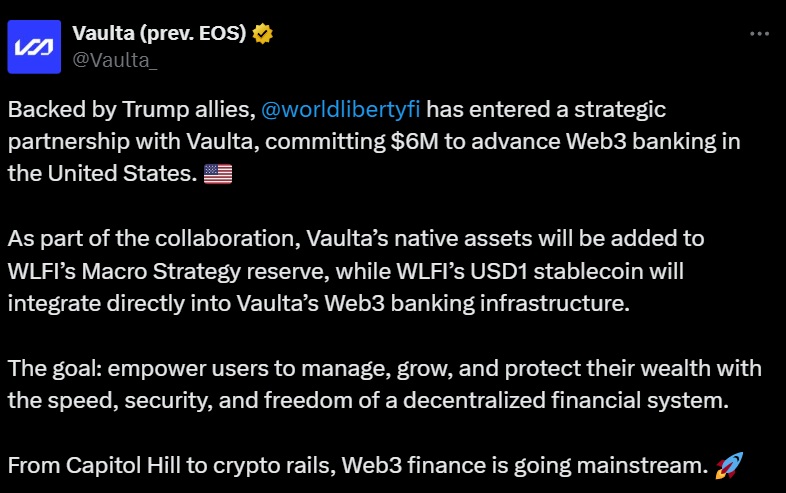

World Liberty Financial forged a partnership with Vaulta—formerly known as EOS—to accelerate the adoption of decentralized financial services in the United States.

As part of the deal, World Liberty bought $6 million worth of Vaulta’s A tokens in May and will add them to its Macro Strategy reserve, which already holds assets like Bitcoin, Ethereum, and TRON. At the same time, Vaulta will begin supporting World Liberty’s USD1 stablecoin within its digital banking offerings.

The collaboration aims to boost liquidity for both entities and simplify access to tokenized assets in everyday transactions. By adding USD1 to its platform, Vaulta broadens its range of payment and custody services, while World Liberty diversifies its portfolio with an asset designed to appreciate and serve as a hedge against market swings.

Vaulta (A) Records Nearly 30% Gain

Since early July, Vaulta’s A token has climbed nearly 30%, reflecting investor interest after World Liberty’s purchase. World Liberty’s Macro Strategy reserve, managed by its investment team, has also expanded, adding 3,400 ETH for $13 million and bringing its total Ethereum holdings to roughly $275 million.

World Liberty’s governance structure has evolved as well: token holders voted to enable WLFI trading, a feature that could activate within six to eight weeks. This change intends to increase the token’s market liquidity and attract new participants to the ecosystem.

While this strategy will extend the reach of the Trump-linked crypto project, critics warn that concentrating financial power alongside political connections poses risks. Alexander Blume, CEO of Two Prime Digital Assets, argued that the Macro Strategy reserve could function as an indirect channel to sway political influence without passing through traditional donation or lobbying regulations.

Nevertheless, World Liberty maintains that its approach merges investment opportunities with the creation of decentralized financial infrastructure. The Vaulta partnership underscores that commitment.