TL;DR

- Bitcoin is facing downward pressure, and short-term holders are the most vulnerable, with increasing unrealized losses.

- Short-term holders’ losses do not reach the levels characteristic of a full bear market but increase the risk of volatility.

- Profit and loss-taking activities remain low, indicating price saturation and potential future volatility.

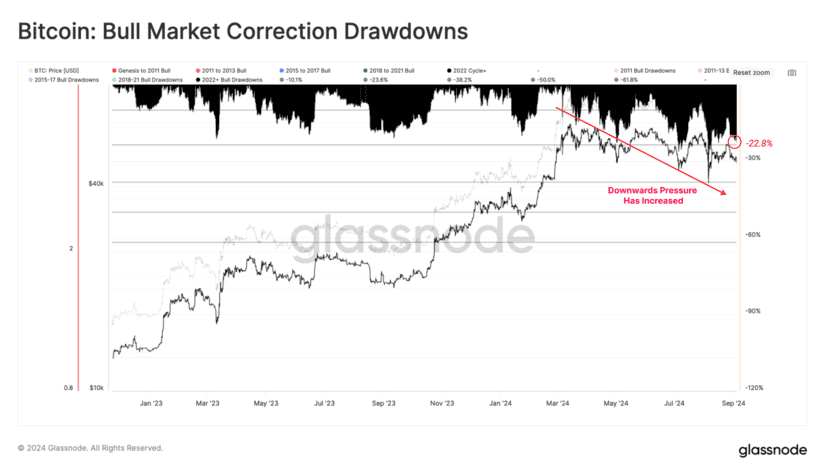

The Bitcoin market has been experiencing downward pressure for several months. This has caused concern among investors, especially those who have recently purchased BTC. Although most investors are still in a profitable position compared to previous cycles, the short-term holder (STH) group has become the most vulnerable, enduring significant unrealized losses.

Short-term holders have seen their losses steadily increase, placing them in a considerable risk position within the market. Despite this, their unrealized losses do not reach the levels typical of a full bear market but resemble the erratic movements of 2019. This suggests that while there is significant pressure, an extreme situation that could trigger panic selling has not yet been reached.

The #Bitcoin market continues to experience downwards pressure over recent months, despite the average Bitcoin investor remaining profitable overall.

However, the Short-Term Holder cohort remains heavily underwater on their holdings, making them a source of risk for the… pic.twitter.com/nlE0K2WgPk

— glassnode (@glassnode) September 4, 2024

Moreover, profit and loss-taking activities remain surprisingly low, indicating a lack of decisive action among investors. The sell-side risk index shows that most coins currently being sold are doing so near their original acquisition price. This could be interpreted as a sign of price saturation in the current range, a phenomenon that has historically preceded periods of greater market volatility.

All Eyes on Bitcoin’s Price

Investor behavior also reflects a gradual increase in loss-taking events, although they have not yet reached the critical levels seen during the bear markets of 2021 and 2022. This slow increase suggests that fear is beginning to seep into investor decisions, which could influence market direction in the short term.

Overall, while Bitcoin is relatively close to its all-time high compared to previous cycles, persistent downward pressure and the vulnerability of short-term investors could lead to increased volatility in the near future. For now, the market remains focused on the $51,000 level, considered crucial for sustaining any potential price recovery.