TL;DR

- World Liberty Financial (WLFI), backed by Donald Trump, announced a collaboration with the Sui Foundation to develop blockchain products and applications.

- WLFI will integrate Sui assets into its “Macro Strategy,” a strategic token reserve aimed at strengthening projects within the DeFi ecosystem.

- This partnership could revolutionize asset management and improve transparency in decentralized finance.

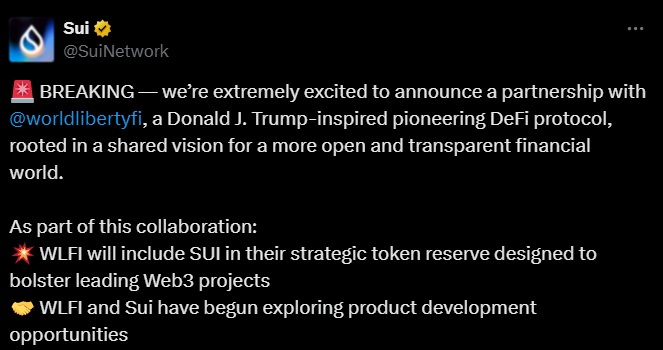

World Liberty Financial (WLFI), the decentralized finance platform backed by U.S. President Donald Trump, has announced a collaboration with the Sui Foundation.

This agreement aims to explore opportunities for developing blockchain products and applications. WLFI will integrate Sui assets into its “Macro Strategy,” a strategic token reserve designed to finance and strengthen projects within its ecosystem.

Sui is a Layer 1 blockchain that has experienced rapid growth in the DeFi sector, achieving massive adoption in recent months. Its technology is considered an ideal complement for WLFI’s initiatives, which seek to expand access to decentralized finance to more Americans. The combination of both platforms’ strengths aims to enhance users’ control over their assets and finances, pursuing greater transparency and autonomy in the sector.

WLFI and Sui Form a Potentially Disruptive Alliance for the DeFi Sector

WLFI, which began to take shape from the interest of Trump’s sons, Donald Trump Jr. and Eric Trump, was officially launched late last year. The platform is not only gaining popularity in the DeFi market but has also rapidly grown after deciding to create a strategic token reserve. Its plan is to acquire tokens from promising projects and incorporate them into its mission to foster the growth of DeFi assets.

The Sui Foundation expressed excitement about the collaboration, noting that the combination of its blockchain technology with WLFI’s goals could break current financial boundaries and revolutionize how the world manages and uses its assets. Sui has established itself as one of the most important blockchains in the industry, with decentralized swap volumes exceeding $70 billion and more than 67 million registered accounts.

Blockchain platforms are looking for ways to adapt to regulation and expand their reach. This alliance could represent a significant step forward in integrating blockchain technology with traditional finance, offering more accessible and transparent solutions for users worldwide