TL;DR

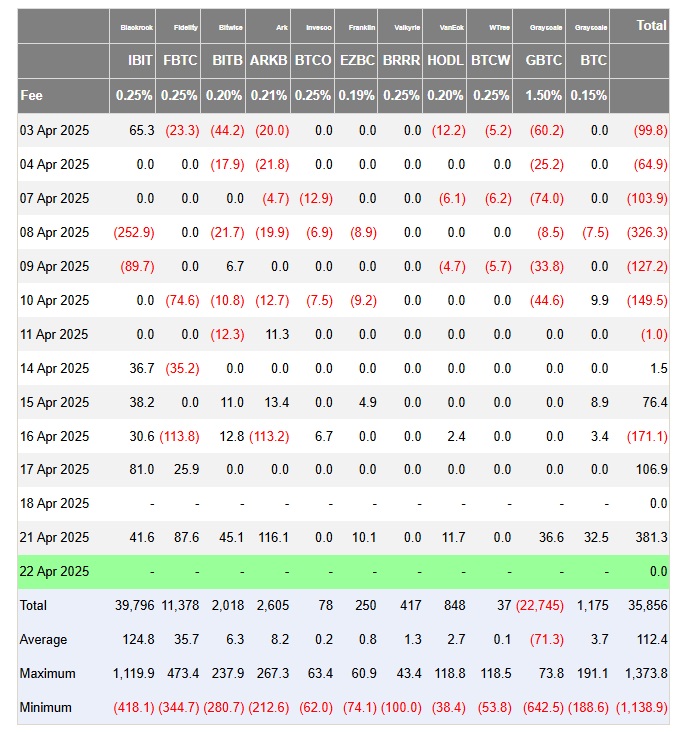

- Bitcoin ETFs saw a $381 million increase in net inflows, the largest in three months, driven by renewed interest from institutional investors.

- Ark Invest and 21Shares’ ETF ARKB was the top recipient with $116.13 million, while Fidelity’s ETF FBTC added $87.61 million.

- Interest in BTC futures reached $58 billion, and the positive funding rate strengthens market optimism.

Bitcoin exchange-traded funds (ETFs) recorded a significant increase in capital inflows, reaching $381 million in net inflows last Monday.

This surge marks the largest increase in three months, resulting from renewed interest by institutional investors in the most prominent cryptocurrency in the industry. The growth is especially relevant considering the moderate activity the ETF market had been experiencing.

Strong Performance of ETFs

Ark Invest and 21Shares’ ETF, named ARKB, was the leading recipient of capital, with $116.13 million, bringing its total to $2.6 billion. Meanwhile, Fidelity’s ETF FBTC garnered $87.61 million, totaling $11.37 billion in historical net inflows. It seems there has been a resurgence in confidence from large investors towards Bitcoin, who appear to have found a favorable environment to deploy their capital.

In addition to the capital inflows, an increase in Bitcoin futures activity is observed, with open interest surpassing $58 billion, indicating that more traders are opening positions in the market. This phenomenon suggests higher participation and positive sentiment towards BTC. As futures contracts increase, so does the likelihood that Bitcoin’s price will continue its bullish trend.

Bitcoin Bullish?

The funding rate of Bitcoin futures contracts also reflects this optimism. Currently, the rate is positive, meaning traders betting on the price increase are willing to pay those betting on a decline. This type of dynamic favors bullish trends, as it indicates that most investors are betting on a bullish behavior in the short term.

The options market also shows signs of recovery, with a higher demand for call options compared to put options. This supports the perception that investors expect BTC’s price to continue rising in the near future.