TL;DR

- Sui has experienced a 120% increase in its value in a month, reaching $2.24, which has sparked investor interest.

- However, allegations of insider selling by investors have emerged, which could affect confidence in the token.

- Investors face a dilemma: capitalize on Sui’s growth or consider the risk of market manipulation.

Sui has caused a stir in the crypto market with a surprising 120% increase in its value in a short period. This increase has awakened investor interest, partly driven by the promotion of the token as an innovation in the digital financial sector. Analysts have highlighted the advanced capabilities of its technology, which promises faster transactions and greater security compared to other cryptocurrencies.

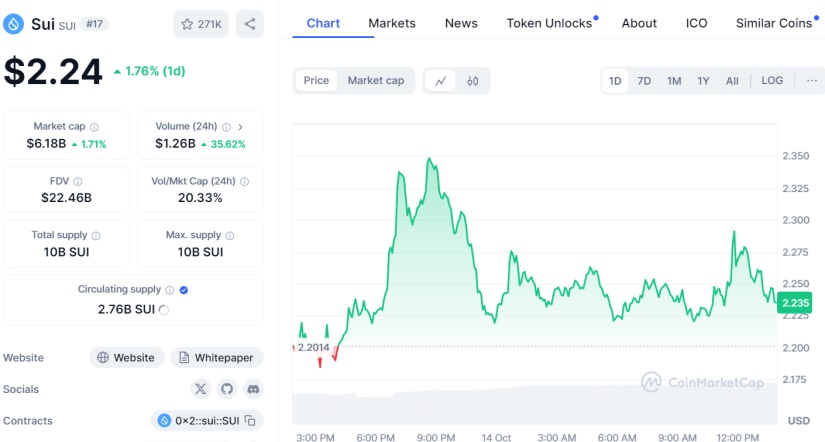

According to data from CoinMarketCap, SUI (SUI) is currently trading at around $2.24 per unit. It has recorded a rise of 1.76% in the last 24 hours, with a market capitalization of $6.2 billion and a volume that has grown by 35.6% in the last day. Just a month ago, it was trading just above $1, achieving a 120% increase in the last 30 days.

Trouble Ahead

However, its meteoric rise is overshadowed by allegations of insider selling that have surfaced amid the excitement surrounding the token. Several reports indicate that some major investors may have sold their holdings just as the price was peaking.

One thing that I've found more and more baffling in the last few weeks is the vertical ascent of SUI, with it quintupling off the lows (Ex 1). The market is starved for winners, and believes it has found one here, yet it all feels awfully chintzy for two reasons that I think feed… pic.twitter.com/VKISXpdxp1

— light (@lightcrypto) October 14, 2024

These actions, if confirmed, could represent an attempt at market manipulation and generate distrust among retail investors looking to capitalize on Sui’s growth. The possibility that certain market players had access to non-public information raises concerns about its fairness and transparency.

A Dilemma for SUI Investors

The current context presents a dilemma for investors considering purchasing Sui tokens. On one hand, the appeal of profiting from its growth is tempting. On the other hand, the risk that insider selling operations could affect the token’s stability and reputation is a factor that cannot be overlooked. The situation demands that investors make cautious decisions, conducting thorough reviews of the available information and constantly monitoring the asset’s performance in the market.

As this situation unfolds, the future of Sui remains uncertain. If the validity of the allegations of market manipulation is confirmed, the consequences could be severe, compromising the token’s position and its appeal to new investors. In contrast, if it manages to navigate these challenges, it could continue generating interest in the long term