TL;DR

- Strategy suffers a sharp correction in its stock following Bitcoin’s drop below $105,000, driven by market volatility.

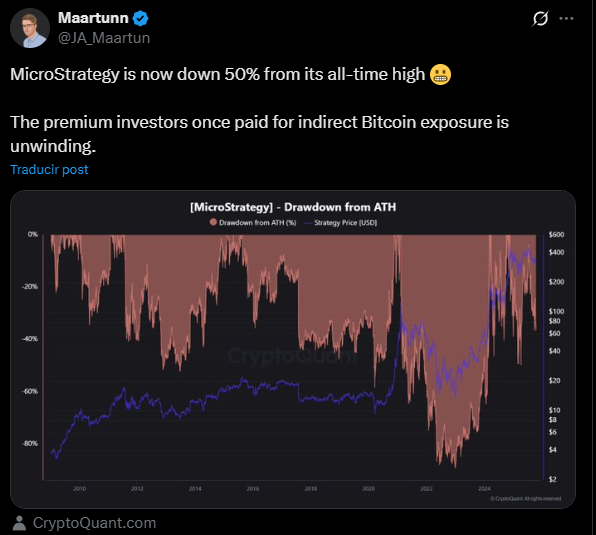

- MSTR shares have fallen nearly 50% from their all-time high of $543 and are trading at $283.84, reflecting a shift in investor sentiment.

- Massive liquidations in derivatives reached $1.2 billion, impacting more than 307,000 traders, while ETH dropped 13% and the crypto market lost 7% in 24 hours.

Strategy is experiencing a significant correction in its stock price due to Bitcoin falling below $105,000.

MSTR shares declined roughly 50% from their all-time high of $543 reached in November 2024 and currently trade around $283.84. This reflects a change in investor sentiment, as they adjust the premium they were paying for indirect exposure to BTC through Strategy stock.

As the largest institutional Bitcoin holder, MSTR’s performance remains closely tied to BTC’s price. Over the past week, BTC lost 14% of its value, and Strategy shares fell more than 12% over the last five trading days. Meanwhile, market volatility has triggered a wave of substantial portfolio adjustments by institutional and retail investors, increasing pressure on the stock price.

Massive Dilution of Strategy’s Holdings

The company holds over $67 billion in Bitcoin, with unrealized gains exceeding $21 billion. However, the market value of its holdings dropped more than $10 billion in just two weeks, down from a peak of $78 billion. Earlier favorable rulings from the U.S. Treasury and IRS allowed Strategy to avoid a multi-billion-dollar tax on its holdings, which had temporarily boosted its stock price.

Derivatives Liquidations

The market decline also caused massive derivatives liquidations, totaling around $1.2 billion. More than 307,000 traders were affected, with long positions accounting for 77% of the total liquidated. The platforms with the largest liquidations were Hyperliquid ($391 million), Bybit ($300 million), Binance ($259 million), and OKX ($99 million). The single largest liquidated position was a $20.4 million ETH-USD long on Hyperliquid.

Ethereum was also hit by the correction. ETH dropped approximately 13% over the week, falling to around $3,794, while the total crypto market capitalization declined more than 7% in 24 hours, reaching nearly $3.5 trillion