TL;DR

- The stablecoin market reached a value of $205 billion, attracting traditional companies like Visa, PayPal, Stripe, and Revolut.

- These tokens are pegged to fiat currencies such as the dollar, offering stability against the volatility of other cryptocurrencies.

- Tether leads the market but must contend with competition from companies like Circle, which have received regulatory licenses in the EU, potentially affecting its dominance.

The stablecoin market has reached a value of approximately $205 billion, attracting the attention of various traditional companies looking to capitalize on its potential.

These digital assets are designed to maintain a constant value, usually pegged to the US dollar or other fiat currencies, making them an attractive alternative to the volatility of cryptocurrencies like Bitcoin. Companies like Visa, PayPal, Stripe, and Revolut are starting to invest in projects related to stablecoins, signaling widespread interest among businesses and institutions.

One of the main reasons behind its succes is that they allow companies to generate additional revenue by issuing tokens backed by reserves, such as short-term US Treasury bonds. This strategy offers attractive returns for issuers. Furthermore, unlike other more volatile cryptocurrencies, stablecoins are gaining traction as a viable option for conducting transactions due to their stability, making money exchange easier without the risks associated with unpredictability.

Is Tether’s Dominance in the Stablecoin Market at Risk?

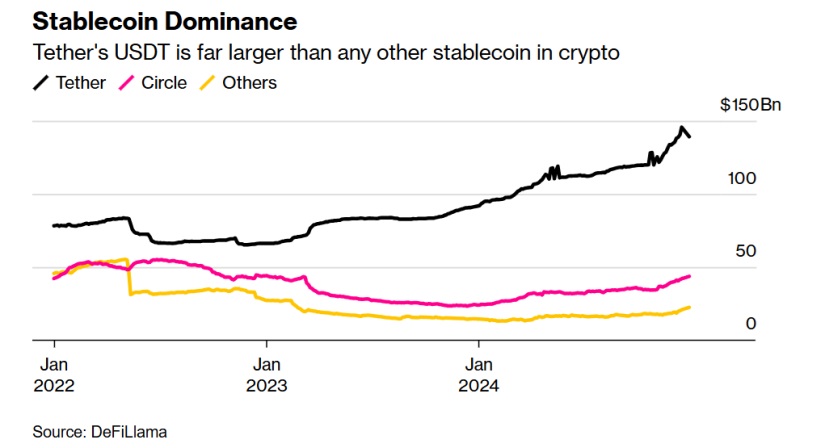

Tether, with its USDT stablecoin, has dominated the market for several years, reaching a market capitalization of approximately $140 billion. However, competition is increasing as companies like Circle have received electronic money licenses in the European Union. This regulation could affect Tether, which has yet to apply for such a license, potentially leading to some exchanges delisting its token.

Meanwhile, several US companies are deepening their presence in this market. Visa, for example, has launched a platform that allows banks to issue stablecoins, while PayPal already has its own token called PYUSD, developed in collaboration with Paxos. Stripe, for its part, acquired Bridge, a fintech platform specializing in transactions with these tokens.

While they offer many advantages, stablecoins also have some weaknesses. The collapse of TerraUSD in 2022 demonstrated the vulnerabilities of some models, especially algorithmic ones. Despite the risks, stablecoins continue to be one of the most attractive options for companies looking to enter the crypto market without exposing themselves to significant risks