TL;DR

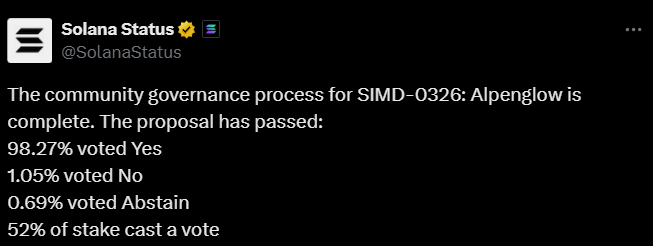

- Solana validators approved the Alpenglow upgrade with 98% support and 52% participation, redefining the network’s consensus and economic model.

- The update introduces Votor, a direct-voting system that reduces transaction finality from 12.8 seconds to just 100-150 milliseconds.

- The new model eliminates vote fees, imposes a fixed cost of 1.6 SOL per epoch, and provides additional rewards to leaders who process fast-finalization certificates.

Solana validators approved the Alpenglow upgrade, a transformation that modifies the consensus architecture and reshapes the network’s economic structure.

What Changes Will Alpenglow Bring?

The SIMD-0326 proposal closed with 98% approval and 52% of the stake participating, paving the way for a system designed to increase confirmation speed and reduce communication costs.

At the core of the update is Votor, a direct-voting system that finalizes blocks in one or two rounds depending on network load. With this design, transaction finality will drop from TowerBFT’s current 12.8 seconds to approximately 100-150 milliseconds.

The new protocol eliminates gossip traffic that currently consumes high bandwidth and replaces it with direct vote exchange using cryptographic aggregates, cutting computational and communication overhead.

Alpenglow applies a “20+20” resilience model, maintaining network continuity even if 20% of validators act maliciously and another 20% remain inactive. The network divides time into slots and assigns leaders for consecutive intervals called leader windows, ensuring clear order in block production.

The update also redesigns economic incentives. Validators will no longer submit vote transactions for each slot and must pay a 1.6 SOL Validator Admission Ticket per epoch as an entry cost. Leaders receive rewards for aggregating and submitting vote data and earn additional bonuses for processing fast-finalization certificates, a task with higher computational requirements. This adjustment removes transaction fees and reduces bandwidth usage while maintaining an economic barrier to validator participation.

A Revolutionary Change for Solana

Analysts noted that the new speed places Solana above typical web search response times, potentially attracting developers and institutional investors. Institutional treasury holdings currently exceed $1.7 billion in SOL. Price projections target $215 by the end of September and $250 by the end of the fourth quarter.

The governance process spanned epochs 833 to 842, including discussion periods, vote recording, and distribution using the adapted Jito Merkle Distributor tool. Validators are now working on technical details and the deployment schedule, aiming to bring Solana’s performance closer to Web2 application speeds while preserving the blockchain’s security guarantees