TL;DR

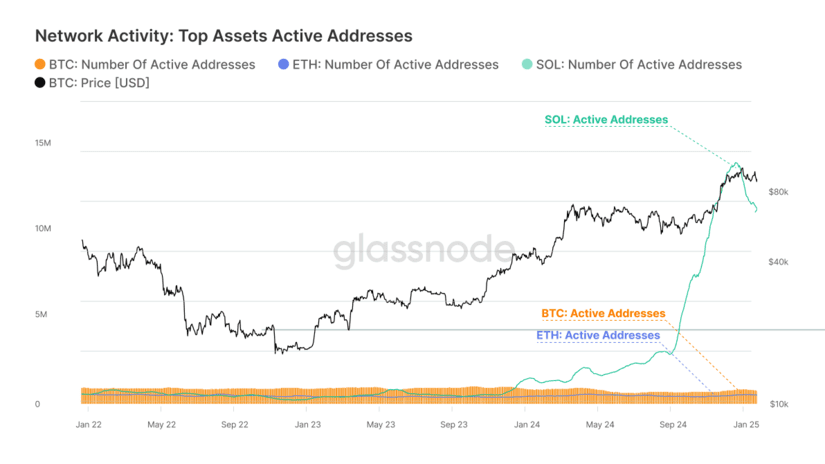

- Solana dominates the retail market: It has surpassed Bitcoin and Ethereum in active addresses and transaction volume, with a 477% surge in memecoins.

- ETFs drive liquidity shifts: Bitcoin ETFs hold over 515,000 BTC, impacting prices and volatility. Ethereum is gaining institutional traction.

- Institutional arbitrage rises: Investors combine ETFs and futures to enhance liquidity and efficiency, with Solana as a potential next target.

Crypto investment flows are shifting with the expansion of ETFs and increasing retail activity. A report by Gemini and Glassnode analyzes the trends shaping 2025, covering institutional adoption, the resurgence of retail interest, and regional differences in demand.

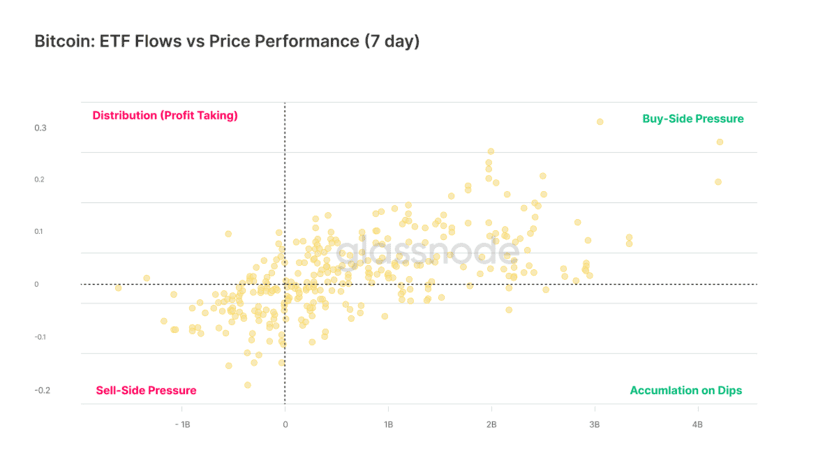

Bitcoin ETFs have accumulated over 515,000 BTC since their launch, influencing market liquidity and volatility. Capital movements within these funds are now closely tied to price fluctuations. Inflows have driven price increases of up to 35%, while outflows have coincided with market corrections. Meanwhile, Ethereum is attracting more institutional interest through its ETFs, with volumes accounting for up to 5% of daily spot market transactions.

New Strategies

The growth of these products has created new arbitrage opportunities. Institutional investors have developed strategies that combine long positions in ETFs with short positions in futures to exploit price discrepancies. This trend has boosted liquidity in futures markets and led to more efficient trading. The expansion of ETFs to other assets, such as Solana, could reinforce this trend in the coming months.

Solana Surpasses Bitcoin and Ethereum

The return of retail capital has shifted market dynamics. Solana has captured a significant portion of this flow, surpassing Ethereum in active addresses. Its ecosystem has seen a rise in speculation, particularly with memecoins, whose aggregate value has grown by 477% since January 2024. Solana has also exceeded Bitcoin and Ethereum in daily transaction volume, reflecting increased network activity.

Regional differences in crypto adoption are becoming more pronounced. While the U.S. market is driven by ETFs and institutional interest, on-chain activity in the Asia-Pacific region has grown by 6.4% over the past year, while it has declined in the U.S. and Europe. This contrast suggests that APAC’s retail market is playing a larger role in speculative cycles, while in the U.S., ETF influence is expected to keep growing