TL;DR

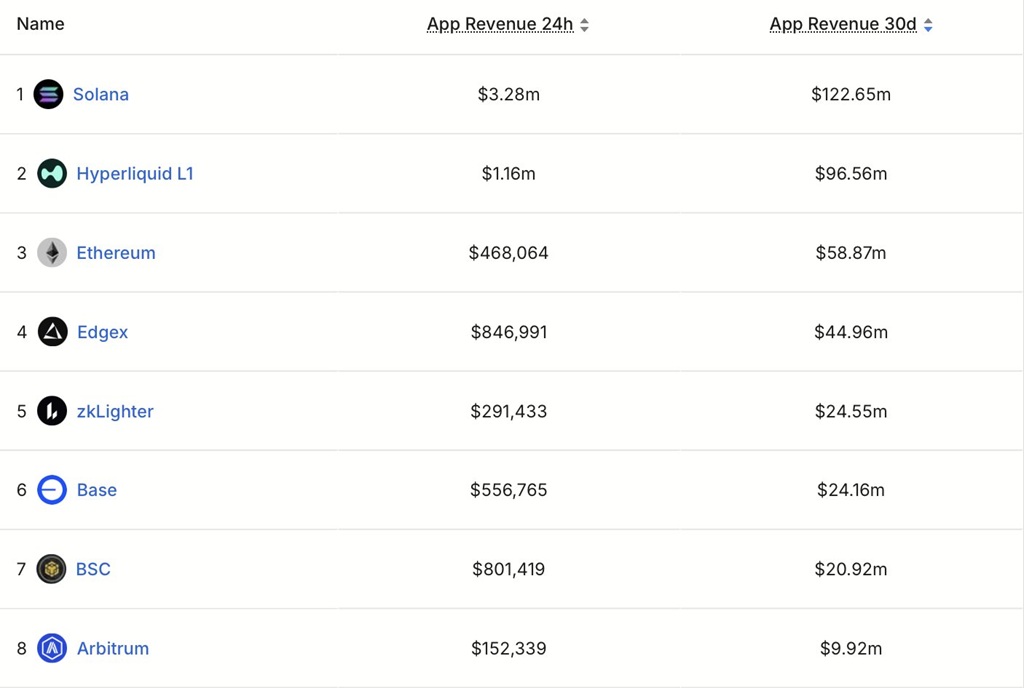

- Solana closed October with $187 million in revenue, surpassing all L1 and L2 chains and confirming steady activity across its ecosystem.

- The network sustained high DEX volume and a stable user base, a mix that showed real usage that does not rely on incentives or liquidity spikes.

- Its performance revealed an operational edge: the network processed more activity without congestion and secured a central position in the DeFi market.

Solana closed October with a figure that reshapes the DeFi landscape: its applications generated $187 million in revenue, leaving all layer-1 and layer-2 chains behind. The performance confirms that the network no longer competes for traction, but for scale, and that its ecosystem managed to sustain real activity even during weeks of volatility.

The flow comes from two pillars: elevated DEX volume and a user base that continues to prioritize its speed and low costs. That mix strengthened Solana’s positioning against alternatives that still depend on incentives or brief liquidity cycles. The data shows organic growth that places the network at the center of the market and explains why the sector uses it as a reference point for measuring effective DeFi usage.

Solana Has No Competition in Speed and Costs

Its performance also highlights its operational advantage: the ability to process activity without slowing down during congestion spikes. The network maintained a transaction base that kept daily revenue steady and reinforced the perception that Solana’s technical design works as a structure ready to absorb more volume without diluting the user experience. Comparisons with other networks show that many are still adjusting costs or scalability in order to retain sustained activity.

Its leadership in DEX trading volume reflects that the network concentrates tactical operations, arbitrage flows, and the use of protocols that require low latency. That combination feeds a cycle where users operate continuously and projects capture revenue that does not rely on subsidies. It is a crucial signal in a market that is beginning to distinguish platforms with real activity from those that depend on speculative cycles.

SOL Fell 31.5% Over the Last Month

Solana (SOL) is currently trading around $127 with a market cap of roughly $71.26 billion and daily volume of $5.03 billion. The token dropped 31.48% in thirty days, a decline that reflected the impact of the broader market correction. Even so, the network sustained record revenue during that same period, a contrast that highlights the separation between token volatility and the chain’s operational performance.

The market already recognizes this pattern. Solana’s position as the leader in revenue and DEX volume gives it a clear narrative: its adoption does not depend on SOL’s price, but on usage. And that usage expanded during a month when most networks saw activity fall