TL;DR

- Robinhood will launch its own Layer 2 blockchain in 2026, where it will host tokenized assets and enable native decentralized operations.

- It will issue 200 tokenized U.S. stocks and ETFs in Europe via Arbitrum, which will eventually migrate to its own network; the company plans to reach 2,000 by the end of 2025.

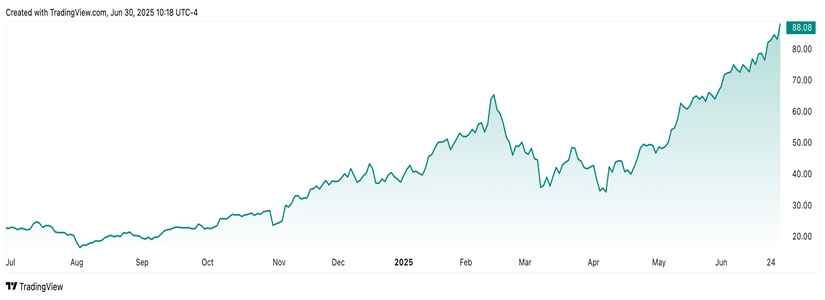

- It will also debut leveraged crypto perpetual futures and ETH and SOL staking in the U.S. Its stock is up 290% so far in 2025.

Robinhood made waves in Cannes by announcing a series of new products aimed at integrating traditional assets and blockchain within a single structure.

Entering the European Market

The company confirmed it will launch its own permissionless Layer 2 blockchain built on Ethereum, set to go live in 2026. This new environment will support native decentralized operations and host a portion of its tokenized asset offering.

The first step will be the issuance of over 200 tokenized U.S. stocks and ETFs for European clients. These instruments will pay dividends directly within the Robinhood app and trade continuously from Monday to Friday. Initially, the tokens will be issued on Arbitrum but will migrate to Robinhood’s proprietary network once operational. The company aims to expand its offering to 2,000 tokenized stocks by the end of 2025.

Robinhood will also roll out crypto perpetual futures with up to 3x leverage, also targeting the European market. These products will go live before the end of summer and will be managed through Bitstamp’s infrastructure, an exchange the company acquired in early June. These initiatives are possible thanks to its MiCA license, which authorizes Robinhood to offer crypto services in all 31 European Union countries.

How Are Robinhood’s U.S. Operations Progressing?

Meanwhile, in the United States, the company is preparing a new set of tools for its domestic users. These include staking for Ethereum and Solana, enhancements to its order routing system, advanced charting tools, and features to optimize tax management for crypto transactions. The rollout of tokenized stocks and perpetual futures in the U.S. remains pending regulatory approval.

Robinhood aims to become a comprehensive investment platform combining traditional and blockchain-based services. Among its upcoming features is a tokenized stock self-custody option, which will allow users to manage their assets from wallets like MetaMask or Rabby and interact with DeFi applications.

A Remarkable 2025

The company is experiencing a year of strong growth. It currently manages $255 billion in assets and has doubled the use of retirement accounts year-over-year. Its stock has climbed 290% in 2025 alone, recently reaching an all-time high of $87 and lifting its valuation to $76 billion