TL;DR

- Robert Kiyosaki warns that the United States is already experiencing a civil war, driven by economic decay and social fragmentation.

- He criticizes central banks for devaluing public wealth through inflationary money printing.

- As a solution, he urges people to invest in Bitcoin, gold, and silver to protect themselves from the collapse of the traditional financial system.

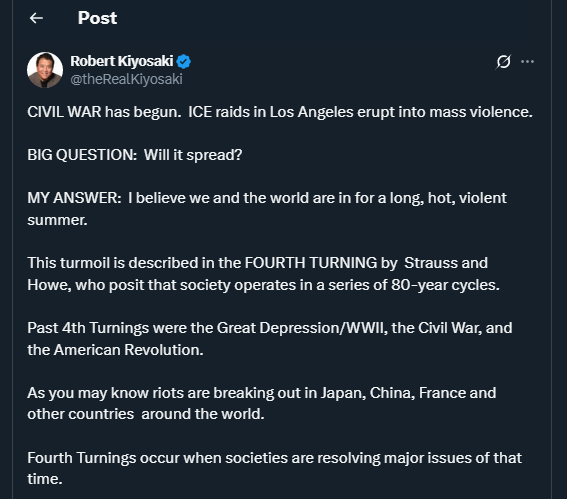

Robert Kiyosaki, bestselling author of “Rich Dad Poor Dad”, has sparked intense discussion with a stark warning: “the civil war has already begun.” According to the renowned investor and financial educator, recent violent incidents in the U.S. and other countries are not random, they are signals of a systemic collapse just starting to unfold.

Kiyosaki connects this rising instability to what historians William Strauss and Neil Howe have called the “Fourth Turning,” a recurring period of crisis that reshapes the social and economic landscape. Previous cycles have included the Great Depression and the World War II. In Kiyosaki’s view, this new turning point is being driven by widespread disillusionment with central banking systems and a deepening loss of trust in fiat currencies.

Bitcoin As A Shield Against Monetary Corruption

Within this landscape, Kiyosaki argues that central banks are actively eroding people’s wealth by flooding the economy with unbacked currency. This inflation, he claims, acts as a form of institutional theft. In response, he strongly recommends shifting away from government-issued money and into assets that are immune to manipulation.

“Sound money—gold, silver, and Bitcoin—takes power away from corrupt bankers,” he recently posted.

To Kiyosaki, Bitcoin stands out as the most powerful tool for those seeking true financial independence. He refers to it as “the people’s money,” unlike fiat currencies, which he believes are controlled by unaccountable financial elites.

Bold Forecasts And Trust In The Crypto Future

Kiyosaki has laid out bold projections for the years ahead. He expects Bitcoin to reach $200,000 before the end of 2025 and predicts it could hit $1 million within the next decade. He also forecasts gold rising to $30,000 per ounce and silver to $3,000, reflecting a major shift away from traditional economic structures.

Other industry voices share his optimism. Analysts like Scott Melker and executives from platforms like Bybit have proposed scenarios in which Bitcoin surpasses $250,000, driven by growing institutional demand and the digital scarcity programmed into its code.

As Kiyosaki warns of a “long, hot, violent summer” not just in America but globally, his message is unambiguous: those who wish to preserve their wealth must move away from fiat and toward hard assets like Bitcoin.