Two days after the XRP snapshot, the Ripple price is on a downtrend. At the time of writing, the coin is down double-digits in the last week of trading. However, there are more upsides, and the dent could be another opportunity for re-adjustment as bulls aim higher for $1 or better.

ODL and XRP Marketing in 2021

Supporters are anchoring their hopes on what’s ahead in the XRPL, and what Ripple has in store for On-Demand Liquidity (ODL).

According to Asheesh Birla, the Managing Director of Ripple, the for-profit company plans to aggressively market the solution and increase the number of ODL partners in 2021.

With more financial institutions using XRP and ODL for cross-border transfers, there will be more demand for the network and coin as a result. For this, a re-pricing higher towards the psychological $1 level could be on the cards.

At the moment, according to David Schwartz, the CTO of Ripple, roughly 20 percent of Ripple partners connecting to the RippleNet suite use ODL. Therefore, if there is a push from the majority owner of XRP to push for more utility of the solution, Ripple might find support.

DeFi in the XRPL

However, the good news following the Flare Network and SPARK distribution is that XRP will find new utility channels besides cross-border fund transfer and trading.

The DeFi wave of 2020 helped push the Ethereum price towards spot levels. Replicating the same in a protocol that’s inherently scalable with the capacity for higher throughput would make XRPL a preferred network and XRP, the choice agent, for executing financial smart contracts, cheaply and securely.

Ripple Price Analysis

At the time of writing, the Ripple price is stable on the last day, but down a massive 16 percent week-to-date.

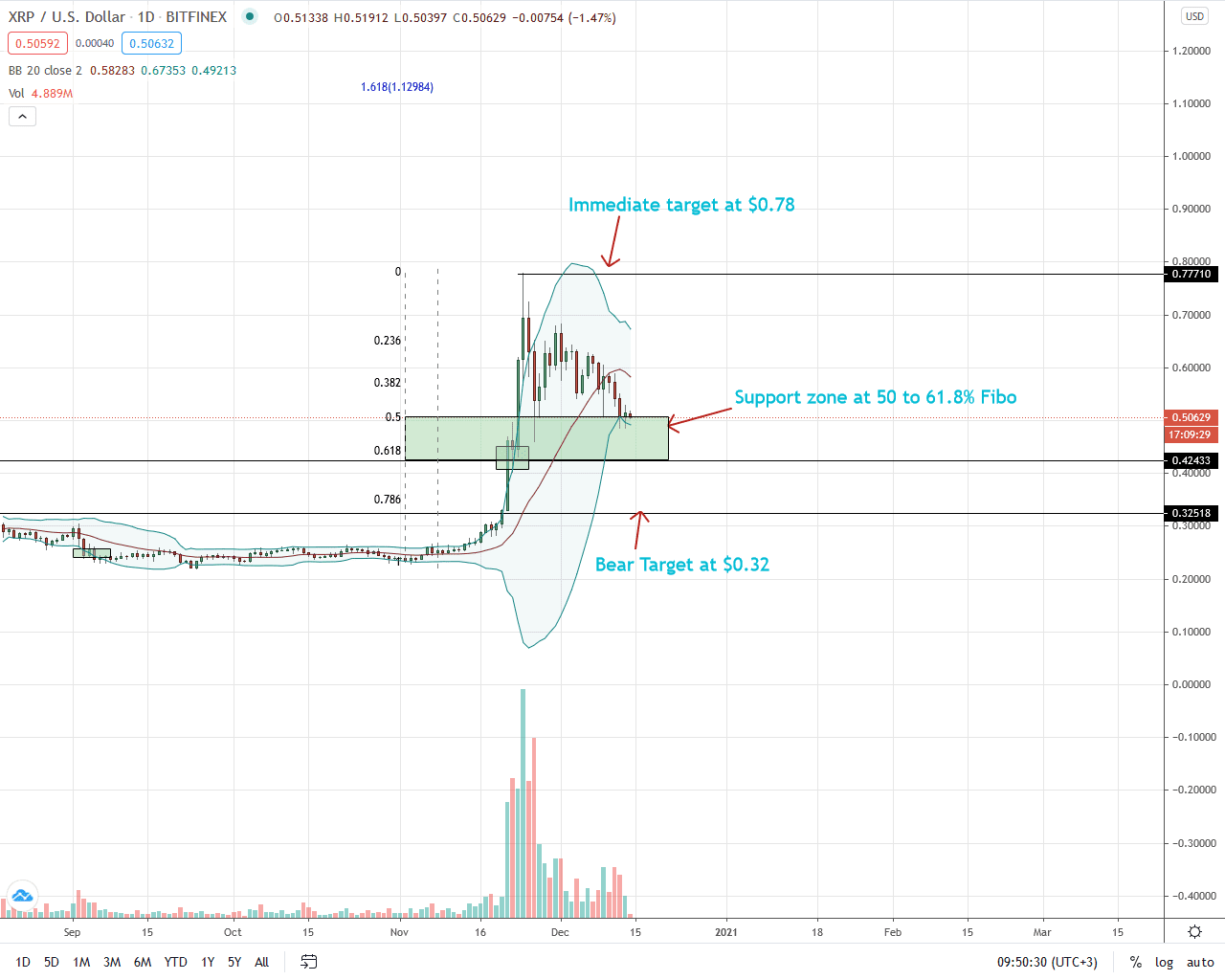

While bears were successful in pushing the XRP price lower, buyers are technically in control gleaning from price action in the daily chart.

Still, there ought to be a rapid re-pricing for buyers to be firmly in charge. Noticeably, prices have been trending mostly within Nov 26 bear candlestick. The conspicuous bear bar had high trading volumes. Subsequent candlesticks didn’t confirm the bar and were with low trading volumes.

For a clear trend definition, there must be a sharp burst above the double-bar bear reversal pattern of Nov 30 and Dec 1 above $0.68 ideally with high trading volumes exceeding those of Nov 26 (Bitfinex data), nullifying sell pressure from a volume analysis point of view.

A close above $0.68 opens the door for $0.78 and possibly $0.80 as the Ripple price prints a new 2020 high.

On the other hand, sharp losses below the 50 and 61.8 percent Fibonacci retracement zone of the November trade range—below Dec 13 gains, may spark a selloff towards $0.43—or worse, $0.30, in a retest.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ripple news