Inevitably, the success of a blockchain project, regardless of how futuristic it is, mainly depends on adoption levels. And Ripple is no exception.

With bases in the United States and is one of the oldest companies in the crypto sphere, Ripple commands attention from investors as well as investors. Specifically, Ripple has sway with financial institutions.

At the core of its operations is to build a system where funds can be moved from one jurisdiction to the next seamless, cheaply, and near instantaneously.

Powering their vision-mission statement is the RippleNet and the On-Demand Liquidity. Their goal is to see more financial institutions use the solution not only for cross-border transfers but in the trillion-dollar Foreign Exchange market.

According to the Bank of International Settlement (BIS), the FX market is the largest in the world, drawing on average $6 trillion in daily trading volumes. For this reason, one of its main partners in the APAC region, SBI Holdings, plans to pilot a project that uses the XRP coin as a tool for facilitating fiat currency swaps.

Ordinarily, ODL via partner cryptocurrency exchanges makes this possible. However, in SBI Holdings’ case, FXcoin Ltd will be the intermediary exchange. The objective is to introduce speed in currency swaps and hopefully by-pass losses related to currency price fluctuations.

It is the nature of the FX market to be volatile since billions of transactions are processed round-the-clock across several banks five days of the weeks without failure.

By integrating XRP, the bank wants to assess whether they will save fees and introduce other blockchain-benefits like transparency within fiat currency swaps.

Ripple Price Analysis

The Ripple price is bullish, adding five percent against the greenback but trailing the BTC and ETH in the last week of trading.

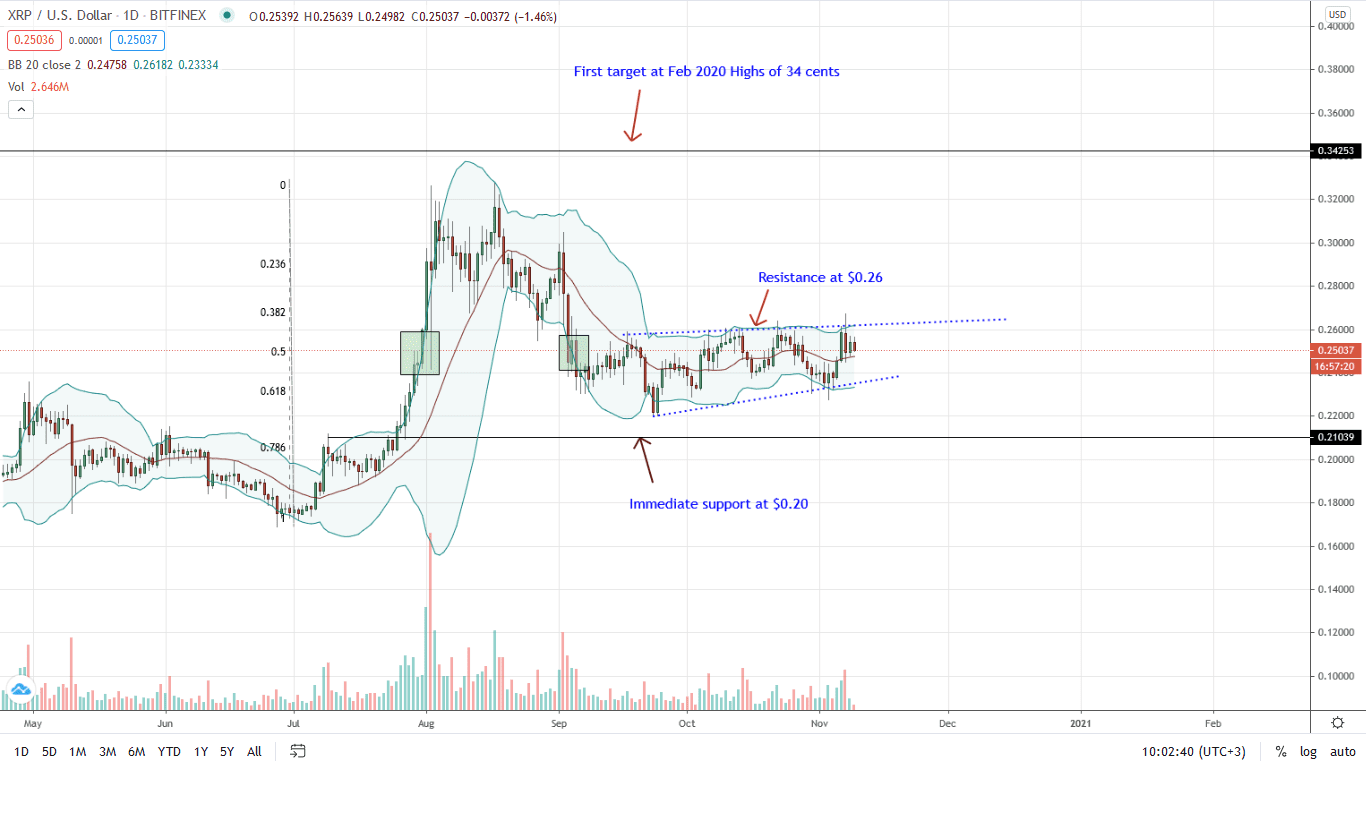

From the daily chart, the Ripple price is trading within a rising channel, a bear flag with caps at $0.26. Technically, every low—as long as prices trend below October 2020 highs and $0.26, is a liquidating opportunity with targets at $0.20.

Further hindering bulls’ march to $0.30 is the level of participation behind early September 2020 liquidation. A similar, high volume close below the support trend line of late September and October 2020 support zone may trigger deeper losses towards $0.20 in the immediate term.

Conversely, buoyed by strong fundamentals especially relating to Spark token distribution and DeFi prospects on the XRPL, the Ripple price may rally above $0.26.

Ideally, this ought to be with equally high trading volumes, preferably exceeding those of Oct 14 and Nov 7 bars—Bitfinex data.

Only then will aggressive traders aim for $0.34, ramping up on dips.

Chart courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author. This is not investment advice. Do your research.

If you found this article interesting, here you can find more Ripple news