For blockchain projects to thrive, they must partner and draw users. In many ways, partnerships with established traditional businesses can jumpstart this but in the long run however, the project’s independence–given the ideals of the blockchain, is a game changer.

Ripple has been successful in that sector.

Over 300 banks were connected by close of 2019 and using the network’s RippleNet for efficiency, security, and end-to-end encryption provided by xCurrent, a solution that is part of the RippleNet suite.

Azimo and Siam Commercial Bank Partnership

There have been developments and new partners in the last quarter and one of them was the announcement that Azimo will be connecting with one of Thailand’s oldest banks, Siam Commercial.

The aim is to eliminate frictions, significantly drop down the cost of remittance, and to generally improve efficiency between users in Europe and those in the SE Asia country.

With RippleNet integration, funds in GBP and Euros can be sent almost instantaneously between the two zones, a benefit for the diaspora who for years had to contend with high cost of sending funds.

Michael Kent, the co-founder and the Executive chair of Azimo, while commenting said:

“Thailand recently launched their instant payment network, and this partnership with the largest bank in the country allows us to get the time to settle payments down from around 24 hours to an average of 22 seconds. [It’s] faster to send money to Thailand than to someone else in Europe.”

XRP was the worst performer in Q1 2020

Still, regardless of the number of partnerships and Ripple refraining from programmatically selling XRP to fund development and XRP use cases, the coin was the worst performer in Q1 2020 according to Messari.

XRP/USD Price Analysis

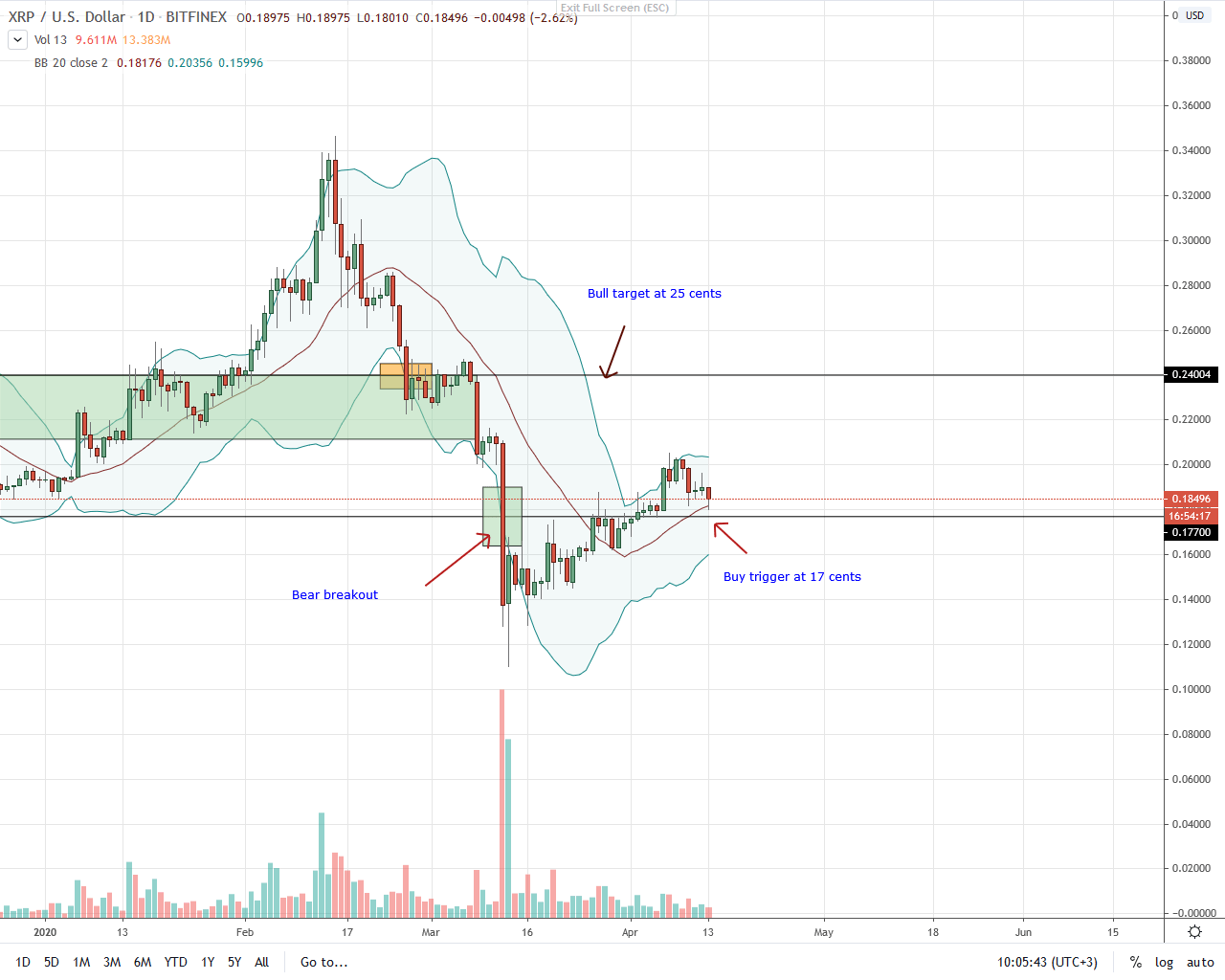

At the time of press, XRP price is range bound and capped below 20 cents. Week-to-date, it is up three percent and encouragingly trending within April 6 high low.

Although prices are ranging within Mar 12 candlestick, the development and rejection of lower prices over the week is an indication of support.

Notably, XRP is trending above the 20-day moving average and April 12’s bar was bullish, printing a three-bar bullish reversal pattern in line with gains of April 6.

From previous XRP/USD price analyses, aggressive traders can buy the dips with targets at 20-22 cents zone which marks Mar 12 high.

On the flip side, losses below 17 cents and specifically 16 cents or Mar 30th lows invalidates this bullish projection.

Disclaimer: This is not investment advice. Opinions expressed here are those of the author and not the view of the publication.

If you found this article interesting, here you can find more Ripple News