Ripple is not posting any significant moves. However, the confidence of the XRP Army is what keeps the coin floating about, positive above critical support lines.

In the medium term, XRP prices might float higher.

Ripple-SEC Case on Focus

The trigger for this shifting sentiment is on the positive development around the ongoing Ripple-SEC case. In what the SEC, the agency, initiated, they seem to be on the losing end given the number of supportive rulings by Judge Sarah Netburn.

Out of this, the XRP Army and neutral observers are convinced Ripple Labs might come on top. The worst-case scenario is cash settlement and continuation of business as expected. Already, Ripple’s operations in the U.S. might have been curtailed but is flourishing, booming outside the SEC reach, especially in S.E. Asia.

SEC is Muzzling Innovation in the U.S.

The contention here, especially among innovators, is that the SEC is implementing laws seeking to cushion and protect investors as they would—it’s their mandate.

However, as they implement what creators say are draconian, retrogressive laws, they are throttling innovation weakening the U.S.’ position as the leader in blockchain.

Critics maintain that the SEC has a habit of picking winners and losers. Besides the case versus Ripple, the SEC has failed to declare ETH a security, yet they raised money via an ICO.

Meanwhile, as the agency trains its muzzles on Coinbase for the exchange’s Lend Program, it is possible that SEC’s employees could have been trading XRP among other coins in a sure conflict of interest.

Ripple Price Analysis

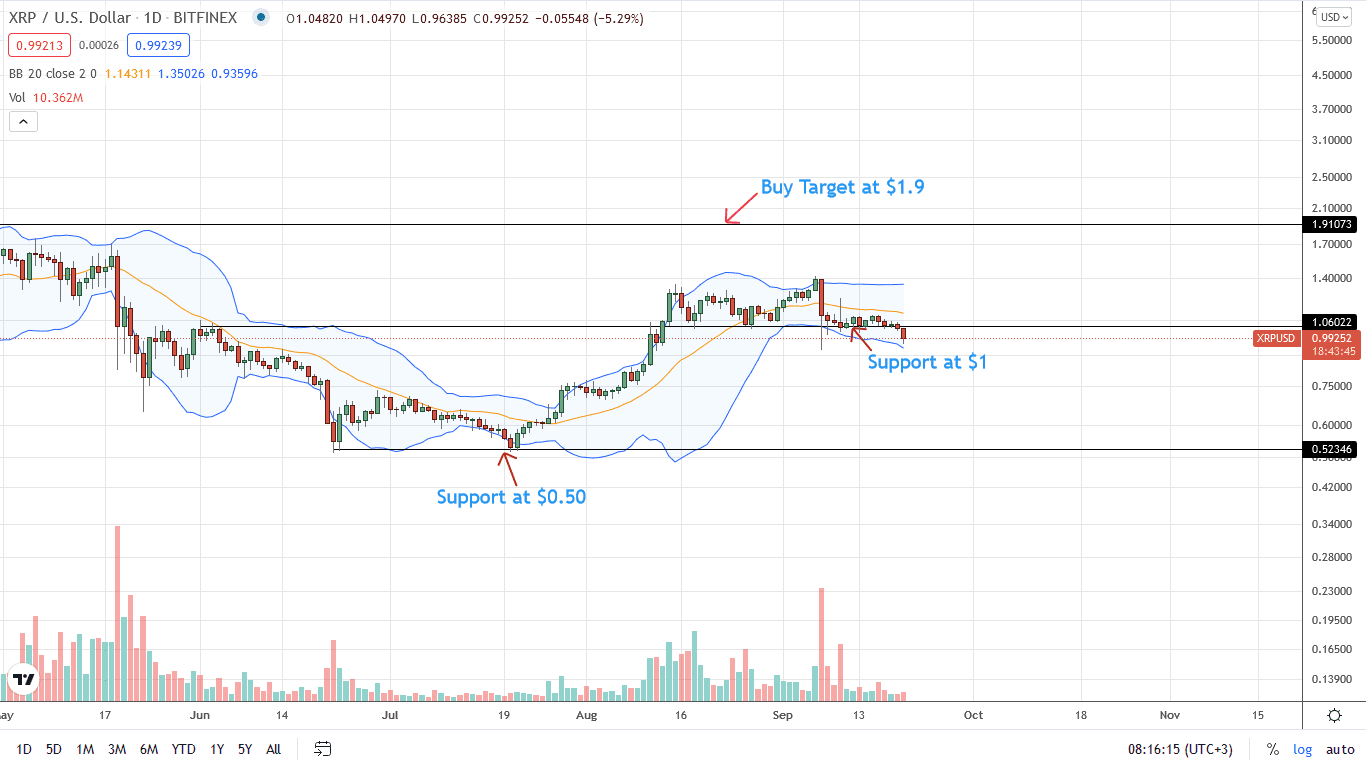

The XRP price is even weak, sliding seven percent on the last trading day as per the Ripple technical analysis of the daily chart.

Overall, Ripple bulls appear to be giving up their lead. Cementing this preview is the failure of bulls to print higher highs as the September 7 bear candlestick continues to define price action, setting the pace.

For August-early September uptrend continuation, there must be an upsurge above $1.4 and September 7 bear candlestick, unshackling bulls. In that case, they may further pump prices towards 2021 highs of around $1.90.

On the flipside, steep losses below last week’s lows might see XRP crumbling in a bear trend continuation pattern set in motion on September 7. If XRP bears take charge below $1, the coin may crash to $0.75 in a retest of 2018 highs.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ripple news