It has been a rollercoaster ride for the Ripple price in 2020. From accumulating for the better part of 2020 before finally erupting to $0.78 ahead of the Spark token airdrop, the cataclysmic-like dump of the XRP price to below $0.20 sent shockwaves for investors.

At the heart of this free-fall was the declaration by the United States Securities and Exchange Commission (SEC) that Ripple, Brad Garlinghouse, and Chris Larsen are liable for selling unregistered securities in XRP, helping raise $1.3 billion.

Before 2018 when questions began to be raised about the state of XRP and whether it was a utility like Bitcoin and Ethereum, Ripple and XRP were indistinguishable.

The Ripple and Ripple Labs Distinction

Now, the team has gone to great lengths, breaking up Ripple into Ripple–the for-profit company, and Ripple Labs–the issuer of XRP.

Still, the SEC is adamant XRP is a security though Brad—the CEO of Ripple, has vowed to fight back the allegation.

Amid his—and Ripple’s assertion, it is the coin holders who bore the brunt. The token freefall meant losses to investors who entered at peak.

XRP Liquidity Crisis?

Additionally, digital asset managers who listed XRP as part of their portfolio—directly or indirectly through derivatives like Exchange-Traded Products (ETP), are closely watching proceedings.

For instance, 21Shares have delisted XRP from two of their flagship ETPs portending a liquidity crunch once heavyweights OTC market providers exit the XRP market.

A few weeks from today, Coinbase will also suspend XRP trading joining a list of other exchanges, including Bittrex and Bitstamp.

Ripple Price Prediction

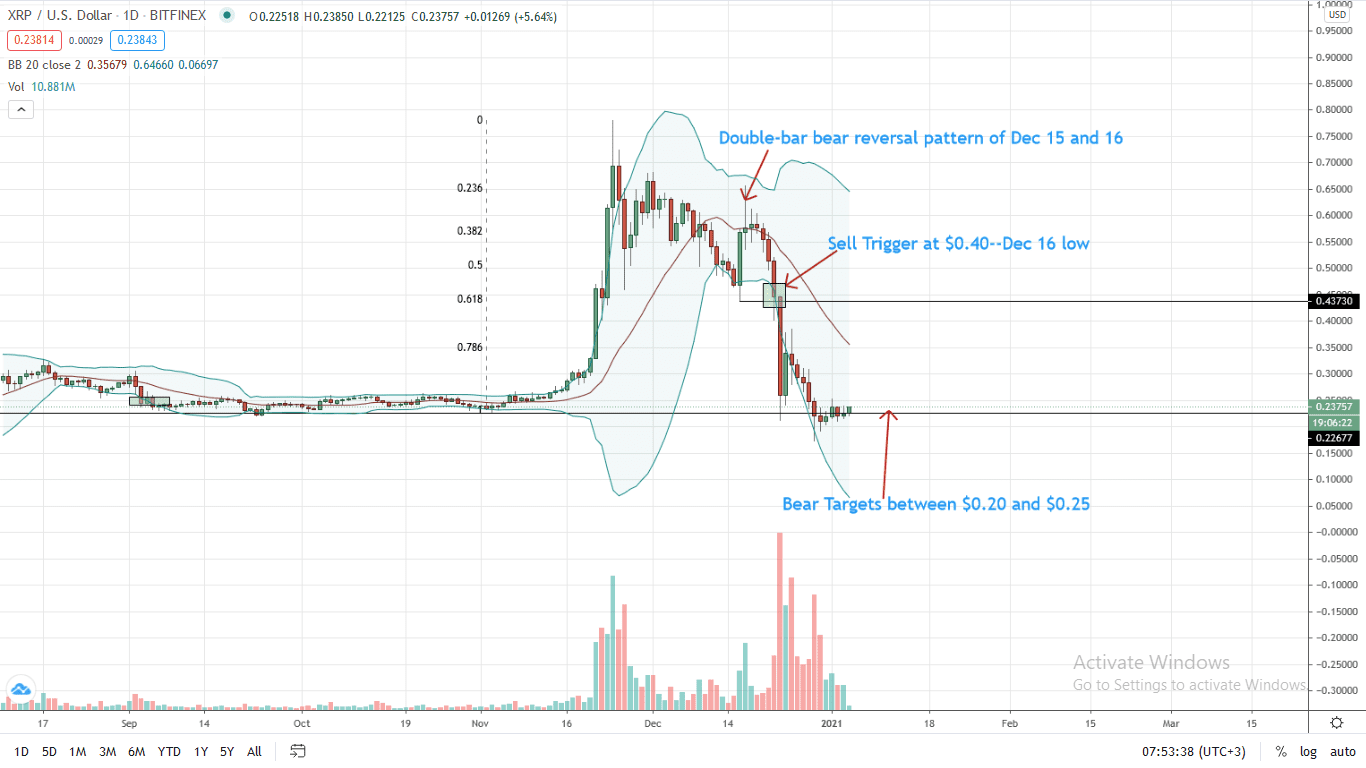

The Ripple price is down 20 percent week-to-date and down to fifth in the market cap leaderboard.

From the daily chart, the path of least resistance is defined, heavily skewed to bears. Notably, bears have completely reversed gains of October and November, sinking below $0.20.

Still, there is optimism.

In the medium term, the trajectory of the XRP/USD pair lies on whether the zone between $0.16 and $0.20 holds. If not, the XRP price likely dips below in sync with last month’s losses to new 2021 lows.

Specifically, losses below Dec 29 lows would confirm the presence of sellers and the distribution of prices in lower timeframes.

Confidence will flow back, however, once the XRP price surge past $0.30. It could reinvigorate bulls aiming for a reprieve, a correction back to $0.44 in a retest.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ripple news