After two weeks of impressive performances, the crypto market collapsed last week. The Ripple price was no exception. At the peak of this month’s performance, the coin’s market cap had soared to $29 billion as prices temporarily flashed past $0.75 according to trackers.

The Significance of September 2018 on XRP Prices

There are several fundamentals to buoy Ripple bulls at a time when market participants are overly apprehensive, fearful of further losses from spot rates to say back to $0.30 or worse.

It has happened before. In September 2018, at the deep of the crypto winter, the XRP price temporarily rallied to $0.82 attracting many investors who sunk millions in expectation of more price gains.

Much to their disappointment, the Ripple price sunk by over 80 percent in subsequent sessions, sinking to as low as $0.16 in 2019. Most lost their hard-earned monies, explaining the current apprehension.

Nov 2020 is Markedly Different from September 2018

The only positive that can be taken in Nov 2020’s rally is the shifting dynamics.

Specifically, unlike 2017 and 2018, there are more users of On-Demand Liquidity (ODL)—a solution that uses XRP for cross-border transfer as a liquidity tool, and the law is a bit more relaxed than them.

Of note, Ripple, the for-profit company has struck more partnerships with intentions of building more use cases around XRP—through gaming with Forte, for instance, its partners rolling out more products to capitalize on DeFi.

For example, SBI Holdings SBI VC Trade now has SBI VC Lending. One of the coins to be supported in the coming days is XRP.

Additionally, Ripple stopped the programmatic sale of XRP to partners instead of urging them to the open markets.

Ripple Price Analysis

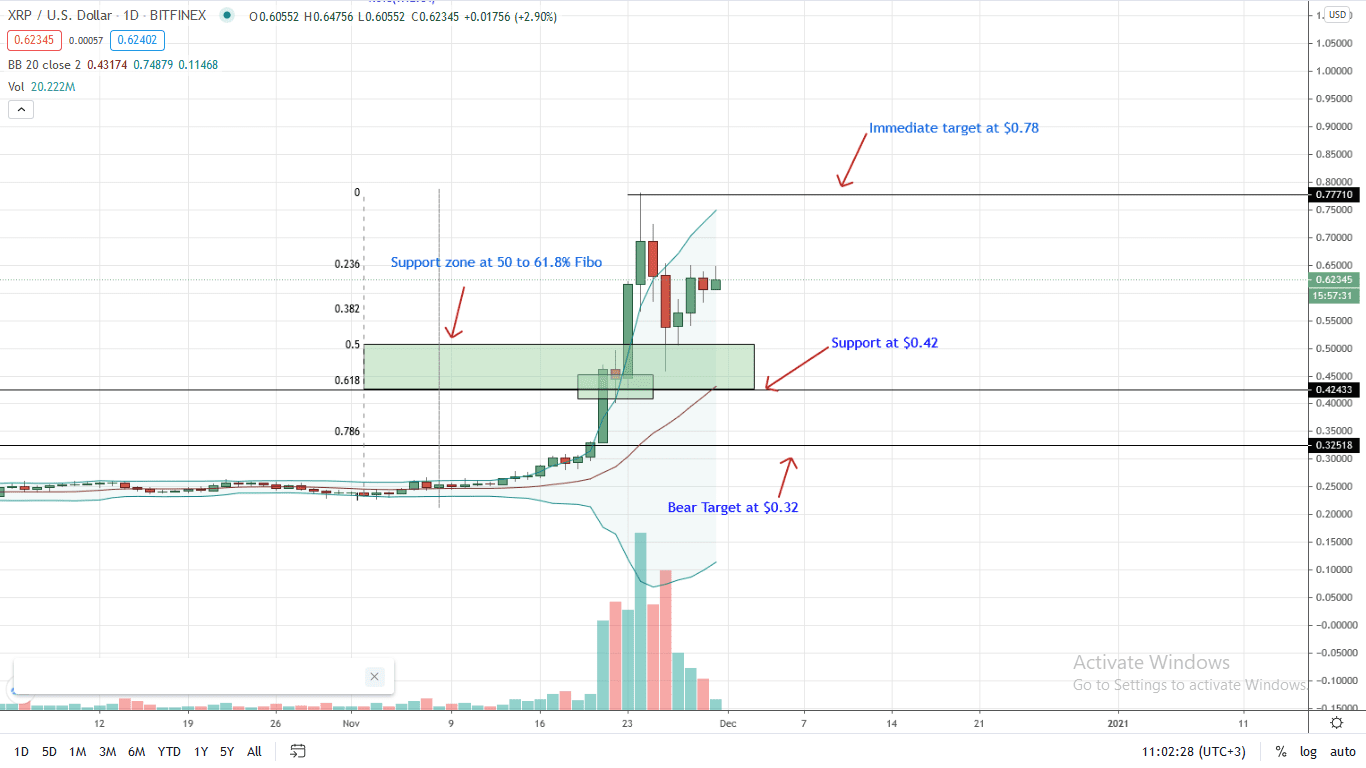

At the time of writing, the Ripple price is stable and bullish. In the last week of trading, the coin is up 34percent, trading at $0.62. It has gained against BTC, ETH, and the greenback.

From the daily chart, bulls are back in contention after the price dip of Nov 25 and 26. Although the correction was expected, traders expected mild dips following rapid expansions in the third week of November.

As it is, buyers are in control. Losses of Nov 26 corrected the over-valuation of Nov 24 and 25. Then, two bars closed above the upper BB, hinting of over-extension and signaling a possible turn; a move which happened.

For now, bulls must drive prices ideally above $0.70—to above Nov 25 highs, with increasing volumes to completely nullify bear attempts of Nov 25 and 26, as volume analysis dictates.

Since the reversal was from the 50 to 61.8 percent Fibonacci retracement levels, the immediate target will be at $0.78 and later the 1.618 level of $1.20 as per the Fibonacci extension levels based on the Nov 7 to Nov 25 trade range.

Chart courtesy of Trading View

Disclaimer: Views expressed are those of the author and are not investment advice. Do your research.

If you found this article interesting, here you can find more Ripple news