The Ripple price is relatively stable, still in red week-to-date. However, on the fundamental front, it is fast-paced, even chaotic.

Will Ripple Sellers Come on Top?

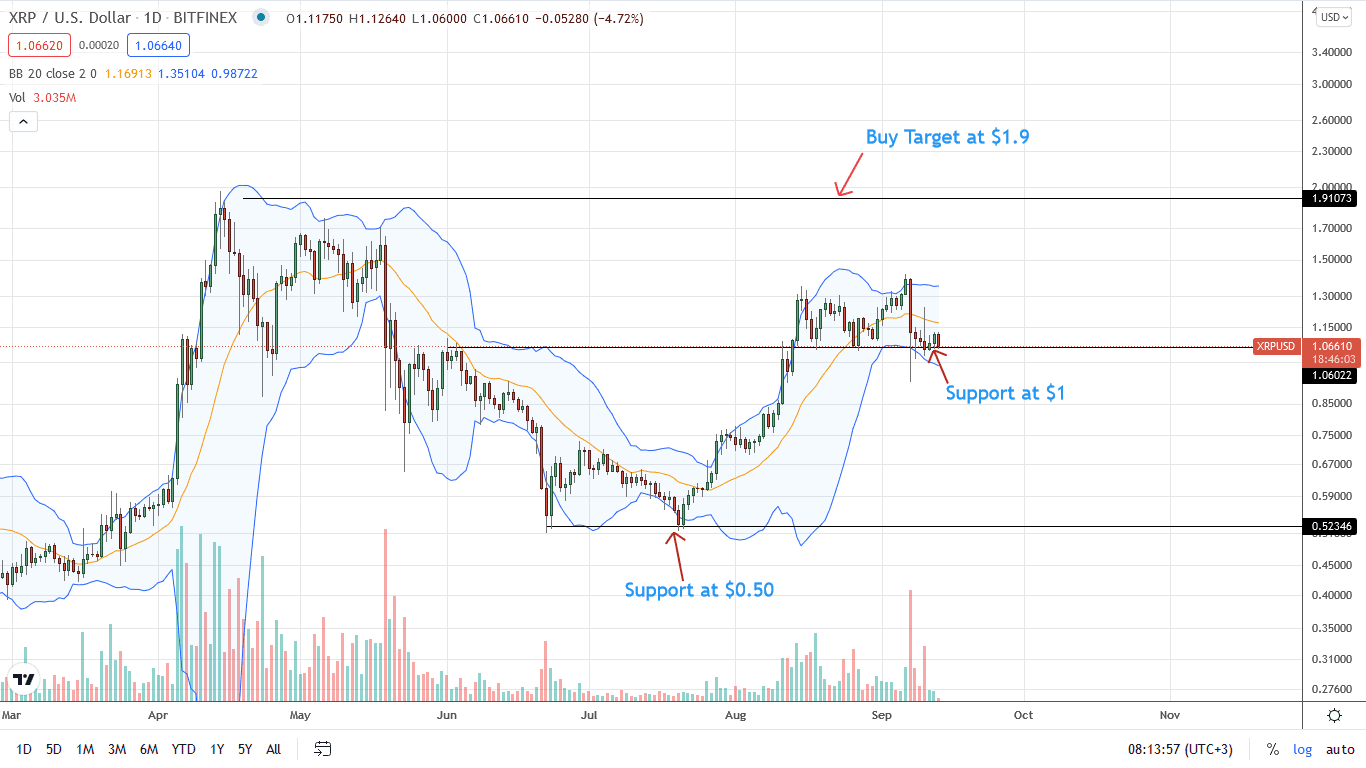

A look at the chart reveals hesitation amongst traders.

On one end, bulls have satisfactorily rejected—absorbing lower lows—given the steady rise of XRP prices over the weekend.

Meanwhile, on the other, fundamentals do offer support, fanning the possible upswing.

Even so, traders shouldn’t be overly buoyant reading the state of Ripple prices in the daily chart. If anything, there are series of lower lows.

Although bullish, Ripple bulls are yet to reverse the steep losses of September 7.

Additionally, the bull bars posted over the weekend are in tight trading ranges, offering support from around the psychological support at $1.

This skews in favor of sellers in the immediate term despite Ripple fans confident of the outcome of the ongoing court case.

SEC-Ripple Court Case Developments

Already, Ripple and SEC agree that the former has no fiduciary duty to XRP holders. It is a decision that saw the XRP Army move forward to make their interests known in the ongoing case.

By doing so, they have shown their willingness to shield their interest just in case there is a downturn, with the SEC winning the case and XRP declared a security.

This ridiculous answer by SEC is consistent with the absurd allegations made in the Complaint.

SEC claims ALL #XRPHolders entered into a common enterprise not just with @Ripple but with every other #XRPHolder in the world and we expected the💰we used to buy #XRP to be pooled.🤦♂️ pic.twitter.com/wTMV004YDP

— John E Deaton (@JohnEDeaton1) September 10, 2021

Meanwhile, Ripple lawyers want a more substantive and more precise answer from the SEC on whether they precleared employees who hold and trade XRP—a coin the agency maintains is an investment contract.

Ripple Price Analysis

The Ripple price is down 19 percent at the time of writing in the last week of trading.

Reading from the price chart, XRP sellers are steady on the last trading day. Notably, prices rebounded from around $1—a psychological support level. There are hints of weakness, and XRP bulls are not off the hook as per the candlestick arrangement in the daily chart.

Since Ripple prices are skewed for bears, bulls must reverse September 7 losses with increasing trading volumes for the shift to trend as per volumes analysis.

If XRP prices continue to move inside the conspicuous bear bar, the coin could tumble below $1 from an Effort-versus-Results perspective towards $0.75 in the medium term.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ripple news