For XRP/USD, a lot depends on the ongoing court case between the SEC and Ripple. The former alleges the latter illegally crowd-funded by selling illegal securities, that is, XRP.

XRP runs on the XRPL, a transparent ledger where central banks can issue their digital currencies.

Nodes are decentralized. Ripple—distinct from Ripple Labs that issues XRP, plans on complete decentralization of both the XRPL nodes and XRP coins.

Legal Winnings

After the judge granted Ripple to seal some of its communication on matters regarding the position of XRP and Ripple’s control of the currency, the same judge forced the agency to divulge its communication on why it didn’t classify ETH and BTC.

Additionally, the judge said Brad Garlinghouse and Chris Larsen didn’t have to reveal their personal financial information.

XRP Relists at Crypto.com

Supporters say these are “key” legal winnings that saw the XRP price surge over 130 percent last week.

It is now trading at 4-year highs, at Q1 2018 highs. Interestingly, it also saw the relisting of XRP by Crypto.com.

It is a massive boost for XRP because, since the SEC lawsuit announcement on Dec 22, several exchanges did suspend the coin’s trading, significantly affecting its liquidity.

If the SEC fails, the XRP price will extend gains confirming last week’s gains.

Ripple Price Analysis

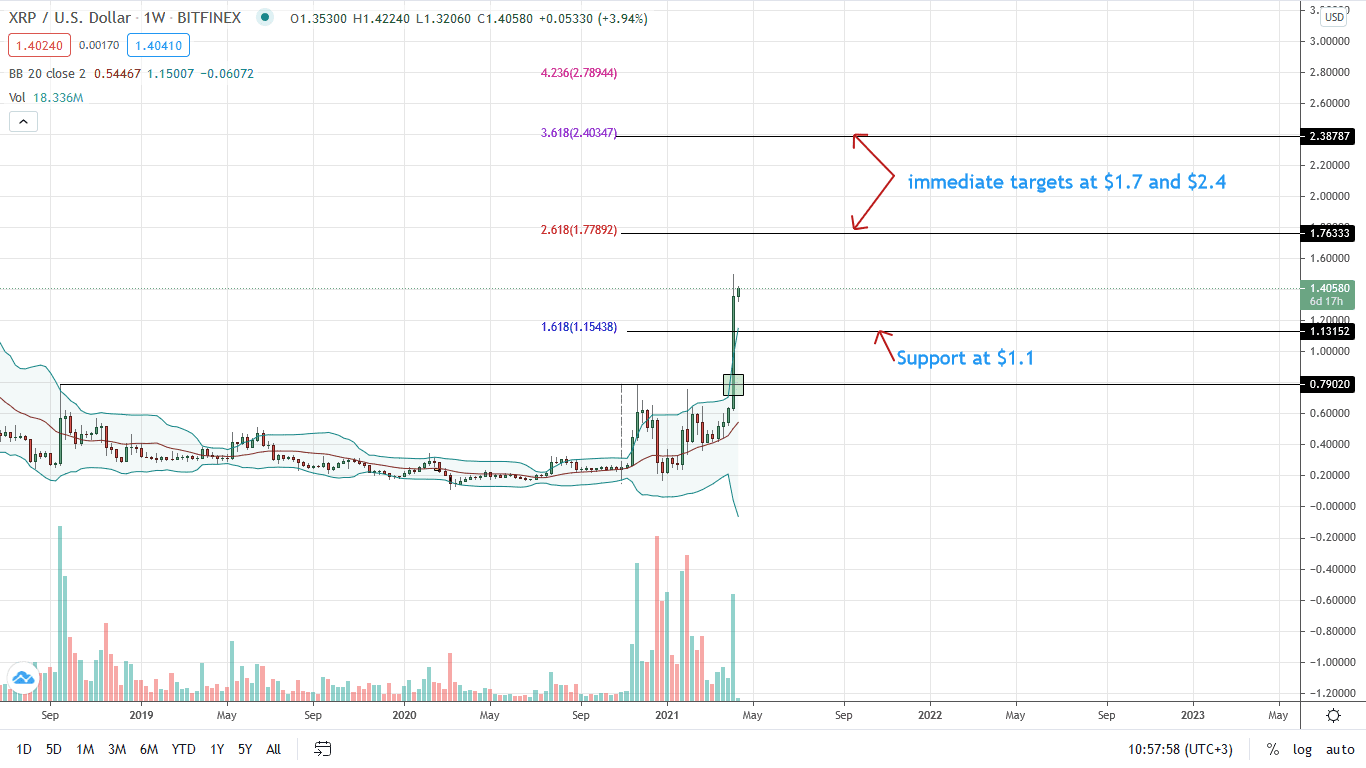

The Ripple price is trading at over $1.40, adding 131 percent week-to-date in a buy trend continuation pattern.

Besides XRP/USD price expansion, trading volumes have been exploding in recent days. Technically, this is bullish as it shows participation.

Most importantly, the sharp gains of last week confirm gains of Sep 2018. Accordingly, every XRP/USD low is potentially a loading opportunity for traders aiming at $1.7 and $2.4, respectively. These are the 2 and 3.618 Fibonacci extension levels of the 4-year trade range.

On the lower end, the $1.1 level—the 1.618 Fibonacci extensions of the same trade range, is immediate support and a point where traders can load on dips.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ripple news