Ripple prices are cooling off at the time of writing. While this is the case, the uptrend is valid, and buyers have the upper hand in the medium term.

Presently, XRP is down six percent versus the greenback week-to-date as last week’s tide recedes, but optimism remains.

Solution for Faster and Cheaper Remittance

In Ripple’s case, buyers are looking at recent fundamental development around implementing their solutions and the level of partner adoption.

Ripple is releasing a solution to promote remittance and allow banks to send funds across borders easily.

While one of their three core solutions uses XRP and XRPL, their adoption spells positivity for the project because of the upgradability of the xCurrent—the project’s popular banking solution.

Ripple Growing Presence in MENA

Apart from development in South East Asia, where Ripple is aggressively working with partners, the firm also extends to MENA.

From their deal with the Kingdom of Saudi Arabia central bank, Ripple has a footprint in Africa through Waya—a Fintech firm operating in Kenya, Nigeria, and Ghana. The goal is to bring instant cross-border fund transfers to millions in the region using Ripple’s rails.

Their entry into Africa is no surprise because the continent is also banking on blockchain solutions for a shift away from expensive bank-enabled transfers.

By leveraging on the blockchain and using cheaper systems, experts say the standard of living of millions across the world would be enhanced.

At the same time, because of expeditious fund transfers, the resulting convenience would be attractive.

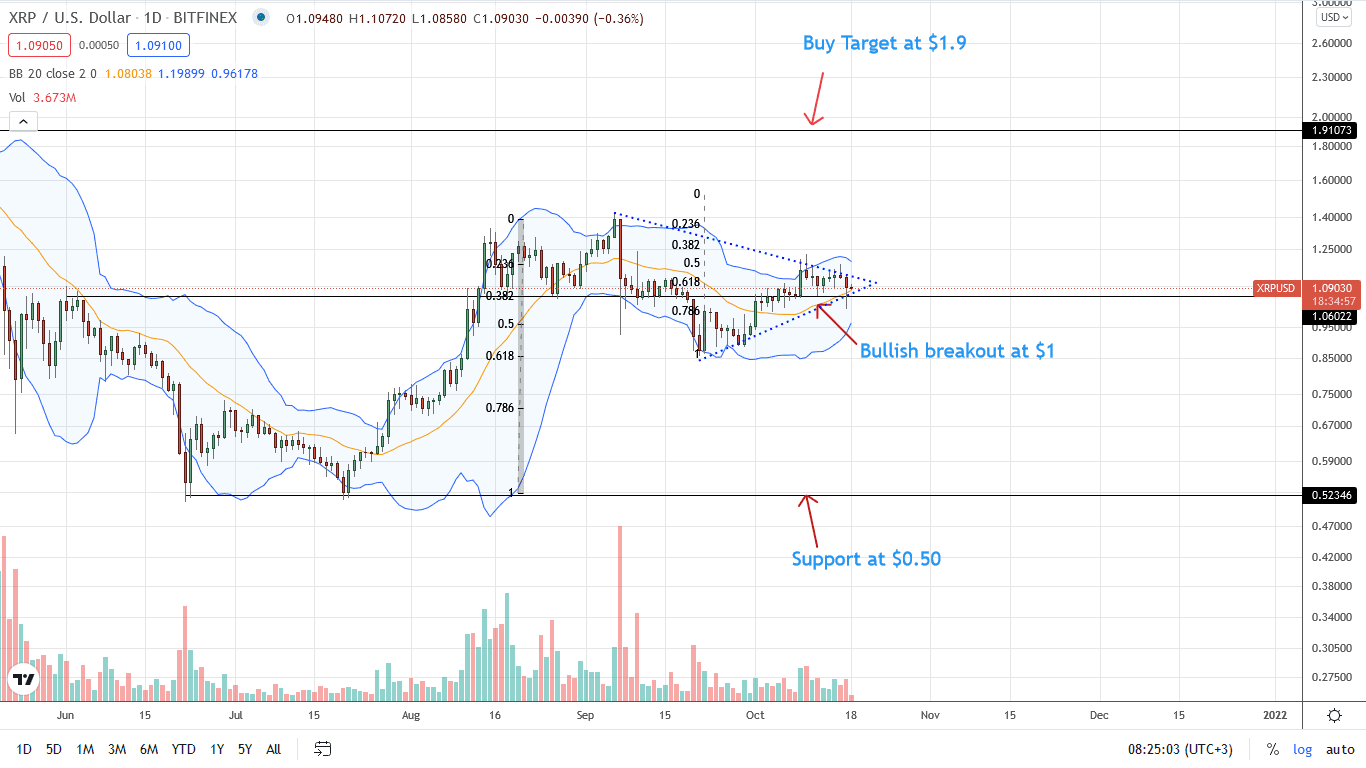

Ripple Price Analysis

The Ripple price is locked in a sideways movement reading from price action in the daily chart.

Sinking five percent on the last trading day, sellers have the upper hand in the short term.

However, this isn’t sufficient to cancel out buyers.

Notably, from the daily chart, XRP/USD prices are still inside the October 9 bull bar, moving inside a wedge, a bull flag.

Accordingly, as long as prices are above the psychological $1 level, every low may provide entries for aggressive XRP bulls targeting $1.20.

Conversely, unexpected sharp losses below $1 could see the coin slump towards September 2021 lows of around $0.85.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ripple news

![Ripple [XRP]](https://crypto-economy.com//wp-content/uploads/2020/07/ripple-pr-1024x576.jpg)