Ripple bulls are buoyant. Adding seven percent week-to-date, traders are bullish, expecting another leg up rewinding losses of the second half of September.

The trend was set following the uptick of last week, which saw XRP prices shoot back above $1, infusing demand to the sixth most valuable cryptocurrency.

While technical candlestick arrangements are overly supportive of Ripple bulls, tailwinds directly stem from the fundamental side of the equation.

On one side, Ripple is embroiled in a court battle with the SEC. On the other hand of the equation, Ripple aims to expand its network, rolling out practical solutions to carve out market share in the lucrative banking sector.

SEC seeking Reprieve from Court over “Oppressive Number of Requests”

Thus far, reports indicate that Ripple might emerge victorious against the SEC reading from previous consecutive rulings from Judge Sarah Netburn.

However, in the latest development, the agency is seeking the court’s protection from the overwhelming number of requests.

The agency said they are being overstretched by the over 250 requests currently under their arms, revealing that they spent over 100 hours analyzing and addressing each request.

The over 30k requests for admission, the agency has revealed, is astonishing and would be unnecessarily burdensome for the agency. They now want the court to disallow the excessive requests which they have described as oppressive.

XRPL Upgrade

Meanwhile, Ripple plans to upgrade its XRPL that will introduce the idea of federated sidechains. Ripple developers say this will allow the ledger to handle DeFi and smart contracts without negatively impacting the efficiency of the public ledger.

2/ Today, XRPL devs can take advantage of the 1st implementation of Federated Sidechains – a toolkit or test lab to build your own blockchain while still enjoying the benefits and functionality of the #XRPL Mainnet. @MonkScott dives in here: https://t.co/uuf3Fda6BW

— David "JoelKatz" Schwartz (@JoelKatz) September 30, 2021

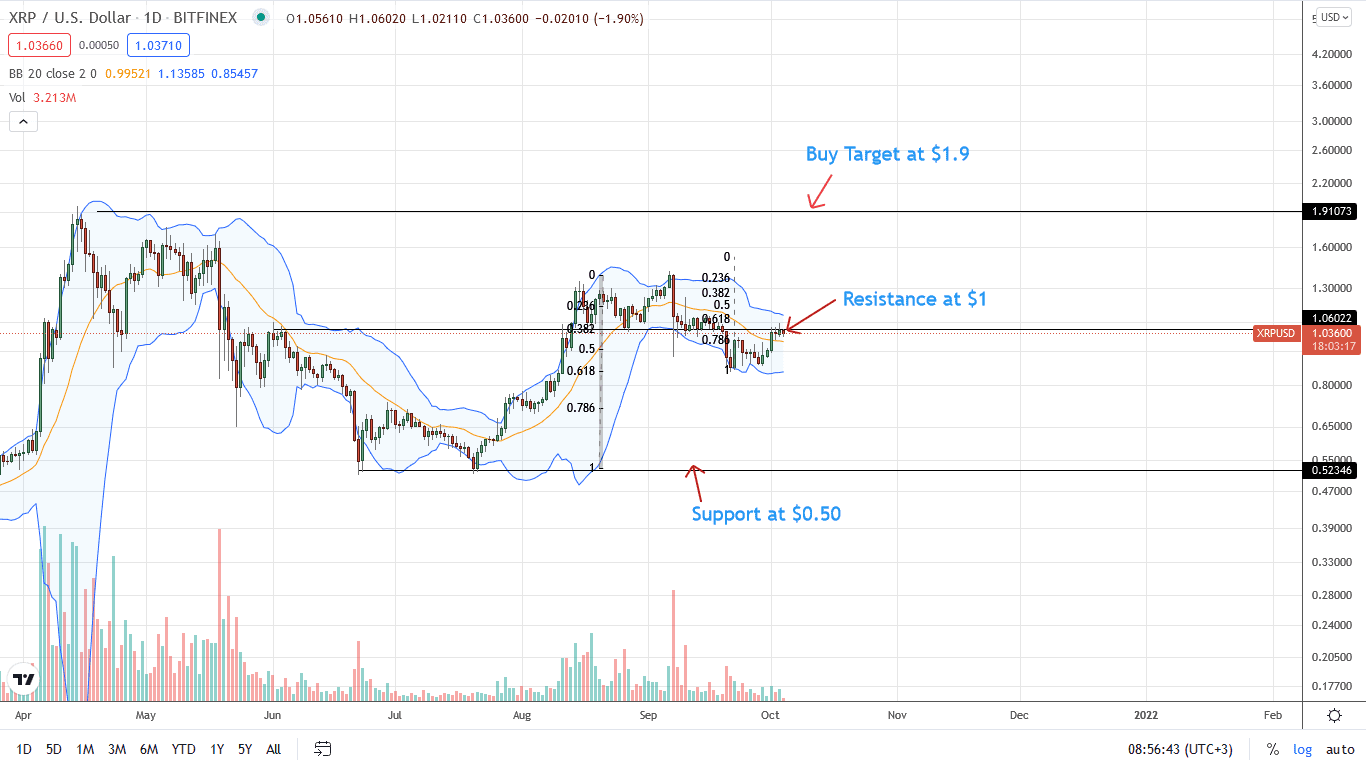

Ripple Technical Analysis

The XRP price is steady on the last trading day, adding seven percent week-to-date versus the greenback.

From the daily chart, there has been a confirmation of bulls of the tail end of last week, pointing to demand and strength.

At the time of writing, XRP prices are trending above the middle BB, an indicator of strength, reversing losses of September 20.

Accordingly, given the break above the middle BB and increasing trading volumes, XRP traders might find entries in lower time frames, loading the dip, targeting $1.2 and $1.4—key reaction points in the immediate term.

On the flip side, losses below $0.90—October 1 lows–, may signal weakness and bear trend continuation back to $0.50—H2 2021 lows.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ripple news

![Ripple [XRP] Price Analysis](https://crypto-economy.com//wp-content/uploads/2020/01/xrp-analisis-1024x576.jpg)