The Ripple price is bouncy, just like the rest of the crypto market. Stability on the last trading day means the coin has posted decent gains in the previous trading week.

Buoying traders is an uptick in participation which could stem from the ongoing court case pitting the blockchain company versus the primary U.S. regulator, the SEC.

Ripple Labs vs. SEC: A Closely Followed Case

Observers agree that the murky regulatory water Ripple finds itself wading in is due to the mismatch in applicable laws– most of which have been applicable since the Great Depression of the 1930s–, and the fast-evolving, disruptive technology presently driving finance.

As the court case drags on, the balance now is the extent of the effects of the financial resolution. This will permanently shape Ripple and the crypto company as a whole.

On the one hand, many wish the court to rule for creating laws that foster the industry’s growth without necessarily training guns or persecuting companies –like Ripple in the space.

On the other hand, many want applicable laws to prevent impeding innovation, resulting in solutions that hasten efficiency while concurrently slashing down on costs.

ODL in Japan and the Asia Pacific

Ripple offers a suite of products under the RippleNet umbrella. The On-Demand Liquidity (ODL) uses XRP–a solution now live in Japan, as earlier reported.

It follows a partnership between SBI Remit and Coins.ph.

Ripple followers say this will set a firm footing to see ODL widely adopted in the Asia Pacific.

Ripple Price Analysis

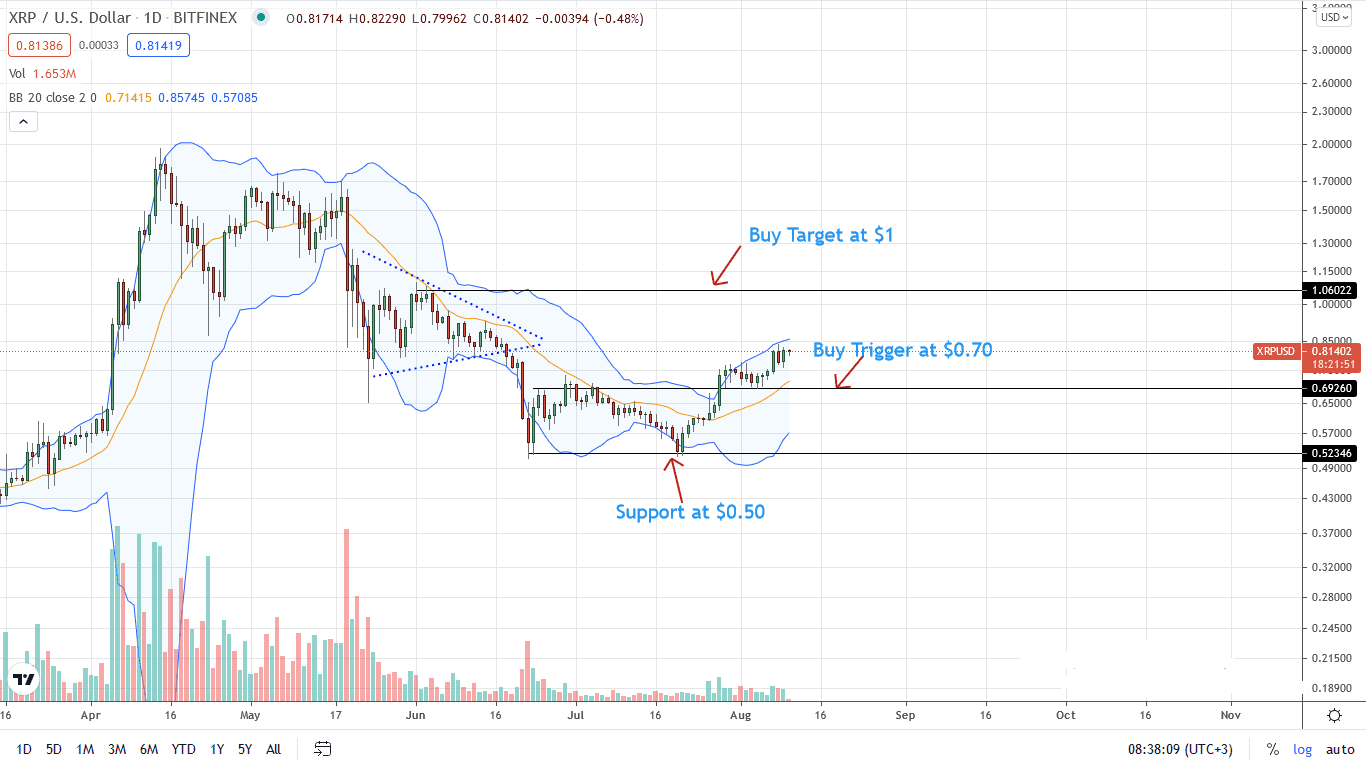

The Ripple price is trading within a bullish breakout pattern, reading from price action in the daily chart.

Although XRP/USD prices contracted on Aug 8, the rebound of Monday places XRP bulls back in contention.

At the time of writing, every low is technically a loading opportunity for aggressive buyers. Noticeably, XRP prices are now within September 2018 highs.

As a result, if there are higher highs from spot levels, clearing last week’s highs, the odds of XRP expanding towards $1 will remain high.

On the lower end, XRP/USD bulls will remain firm if $0.70 holds. It is a level of interest for buyers. If sellers flow back and XRP prices shrink from spot levels below $0.70, the uptrend will be dashed, a case for XRP to possibly drop back to $0.50.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ripple news

![Ripple [XRP] Price Analysis](https://crypto-economy.com//wp-content/uploads/2020/01/xrp-analisis-1024x576.jpg)