TL;DR

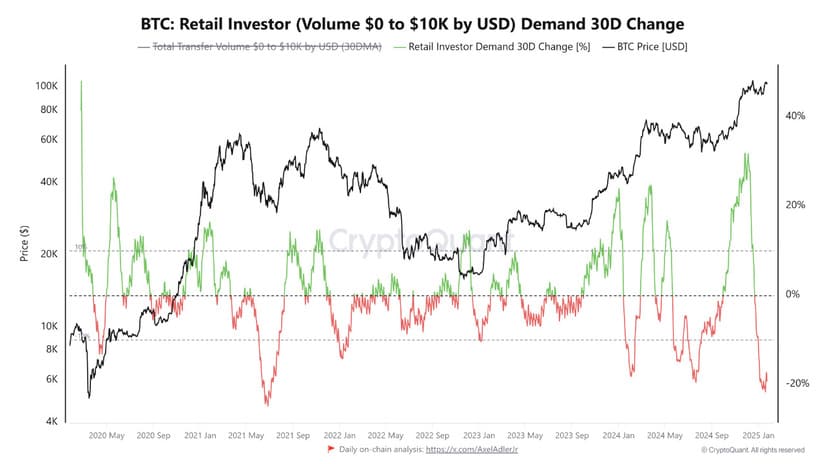

- Blockchain activity for retail transactions dropped by 19.34%, even as Bitcoin remains above $100,000 and near its all-time high.

- Interest in cryptocurrencies has grown compared to last year but focuses on isolated events that trigger activity spikes.

- Low retail participation could limit future Bitcoin rallies, as high prices are not generating the same excitement as in previous years.

Blockchain activity related to retail transactions has fallen by 19.34% in recent days, according to reports from CryptoQuant.

This decline comes despite Bitcoin’s price holding above $100,000, fluctuating within a range of $100,000 to $109,000 since the start of the week. This behavior suggests reduced interest from small investors, even though BTC is near its all-time high.

Isolated Events and Activity Spikes

Analysis indicates that interest in Bitcoin and other cryptocurrencies has increased compared to last year but does not reach the levels recorded in 2021. During that time, the approval of Bitcoin ETFs drove massive attention to the market. In contrast, current interest seems to center on isolated events that produce brief activity spikes, such as the recent launch of Donald Trump’s meme coin.

The meme coin initially reached a market capitalization of $15 billion, generating significant initial interest reflected in online searches. However, after a 55% drop in its value, enthusiasm has declined, along with overall retail user participation. In general, searches related to terms like “Bitcoin” and “cryptocurrencies” show moderate growth but remain insufficient to translate into a significant increase in on-chain activity.

Low Retail Interest Could Limit Bitcoin’s Upside

Historically, market behavior has shown that volatility drives retail on-chain activity. However, this relationship appears to be changing, as current data suggests small investors are not participating actively, even with the market at high price levels. Retail participation peaked in December and has been declining since.

Analysts point out that, while on-chain indicators show stability in the Bitcoin market, the current levels of retail interest could limit the momentum of future rallies. High prices no longer seem sufficient to sustain enthusiasm