TL;DR

- Bitcoin rose 2.6% in December amid very low liquidity and without meaningful liquidations; the move was driven by spot and perpetual buying, not by market stress.

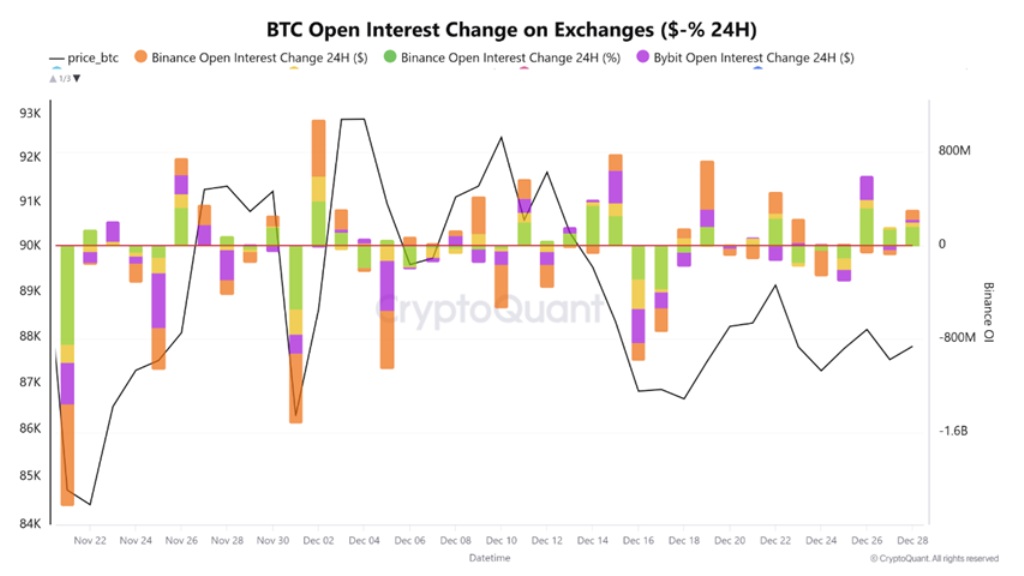

- Open interest fell by nearly 50% after the options expiry, confirming capital outflows and a market with reduced depth.

- The $94,000 level could trigger gamma-hedging buying, but without fresh volume and with higher leverage, any breakout lacks structural validation.

Bitcoin closed December up 2.6% in an environment of very low liquidity. There were no significant forced liquidations: long liquidations stayed below $40 million. The move was driven by spot and perpetual buying in a thin market, not by stress or structural positioning shifts.

The key data point is the collapse in open interest after the options expiry. Following Friday’s record expiry, open interest dropped by nearly 50%. That signals capital exiting and lower participation. The market is operating with less active money and reduced depth. Price is moving, but without backing.

Why $94,000 Matters for Bitcoin

Dealers shifted from being long gamma to short gamma on the upside. In that setup, every price increase forces hedging through spot BTC purchases or short-dated call options. This mechanism pushes BTC higher without the need for organic demand. The effect appeared when Bitcoin briefly moved above $90,000, driven by concentrated buying in perpetuals and calls clustered around $94,000.

The $94,000 level remains a key technical reference. A move above that price could amplify forced buying tied to gamma hedging. That does not imply structural strength. It reflects derivatives mechanics. Without new volume, these types of rallies tend to lose momentum quickly.

On the downside, hedging demand has eased. The large $85,000 December put was not rolled. Short-term demand for protection declined. Even so, spot ETF outflows continue and selling pressure during US trading hours remains in place. Support around $86,000 is still holding, but due to a lack of aggressive sellers, not because of accumulation.

Leverage and Open Interest

Leverage is another factor to watch. During December, roughly $2.4 billion in leverage was added despite activity dropping by nearly 40%. Combined Bitcoin and Ethereum futures open interest rose from $35 billion to $38 billion. The Fear Index sits at 27, but the market has not cleared positions.

That behavior does not align with a solid bottom. Market bottoms form when leverage declines and positions are closed. Here, the opposite is happening: traders are maintaining and opening new positions, betting on rebounds while real capital stays sidelined.

Bitcoin remains above $87,500, with a fragile technical structure and limited price movement. The price may continue to shift due to different mechanical effects. However, as long as volume does not return and leverage keeps rising, any breakout will lack validation