TL;DR

- VanEck warns that firms buying Bitcoin through stock issuance should halt the strategy if their share price drops to the level of their BTC reserves.

- Semler Scientific has lost over 45% in 2024, with its market cap now barely above the value of its Bitcoin holdings, trading at a 0.82x multiple.

- VanEck advised suspending offerings, prioritizing buybacks, and reviewing strategy if the discount persists — including abandoning Bitcoin accumulation.

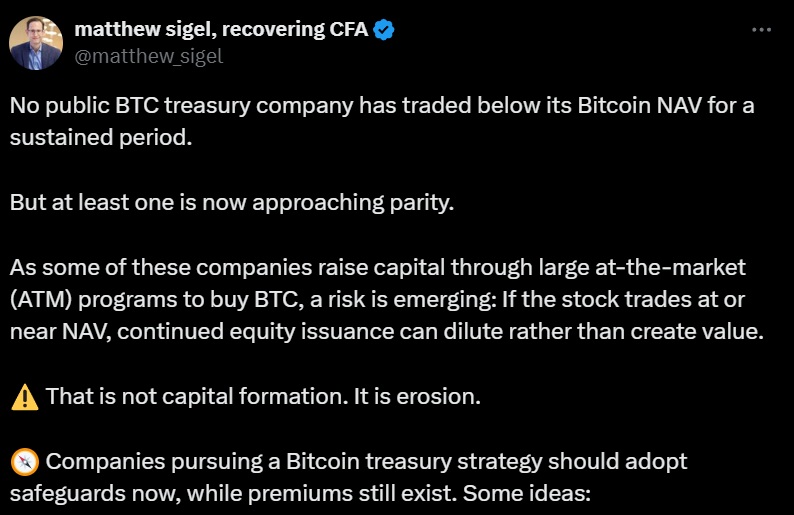

Publicly traded companies investing in Bitcoin face an increasingly complicated environment. According to VanEck, firms financing crypto purchases through equity issuance should reconsider that approach if their share price falls to match the net asset value of their BTC reserves. The warning highlights the risk of diluting shareholders without creating real value, especially when shares already trade without a premium relative to their digital assets.

The case of Semler Scientific illustrates this issue. The medical technology firm, which since May 2024 has accumulated over 3,800 BTC valued at $404.6 million, has seen its stock price drop by more than 45% this year. Its market cap now hovers around $434.7 million, dangerously close to the value of its Bitcoin holdings. This pushed its net asset value multiple down to 0.82x, leaving the company on the edge of an unsustainable situation if it continues issuing shares.

VanEck’s Recommendations

VanEck suggested halting at-the-market share offerings if the ratio between market cap and net asset value falls below 0.95x for at least 10 days. It also recommended prioritizing stock buybacks when Bitcoin’s price rises but the company’s equity fails to reflect those gains. If the discount persists, VanEck advised launching a strategic review, which could include mergers, spin-offs, or abandoning the BTC accumulation policy altogether.

Can the Bitcoin Playbook Backfire?

Many companies that went heavily into Bitcoin funded those purchases with debt or new stock issuance, betting that crypto’s price gains would lift their share value too. But markets don’t always price those gains into stock valuations. Once the premium over asset value disappears, new equity issuance simply hurts existing shareholders.

VanEck also proposed revising executive compensation structures. It views it as more reasonable to link bonuses and incentives to growth in net asset value per share, rather than to the size of Bitcoin holdings or the number of shares issued. According to its analysis, many of these companies still have time to act — but they’ll need to move before options run out