TL;DR

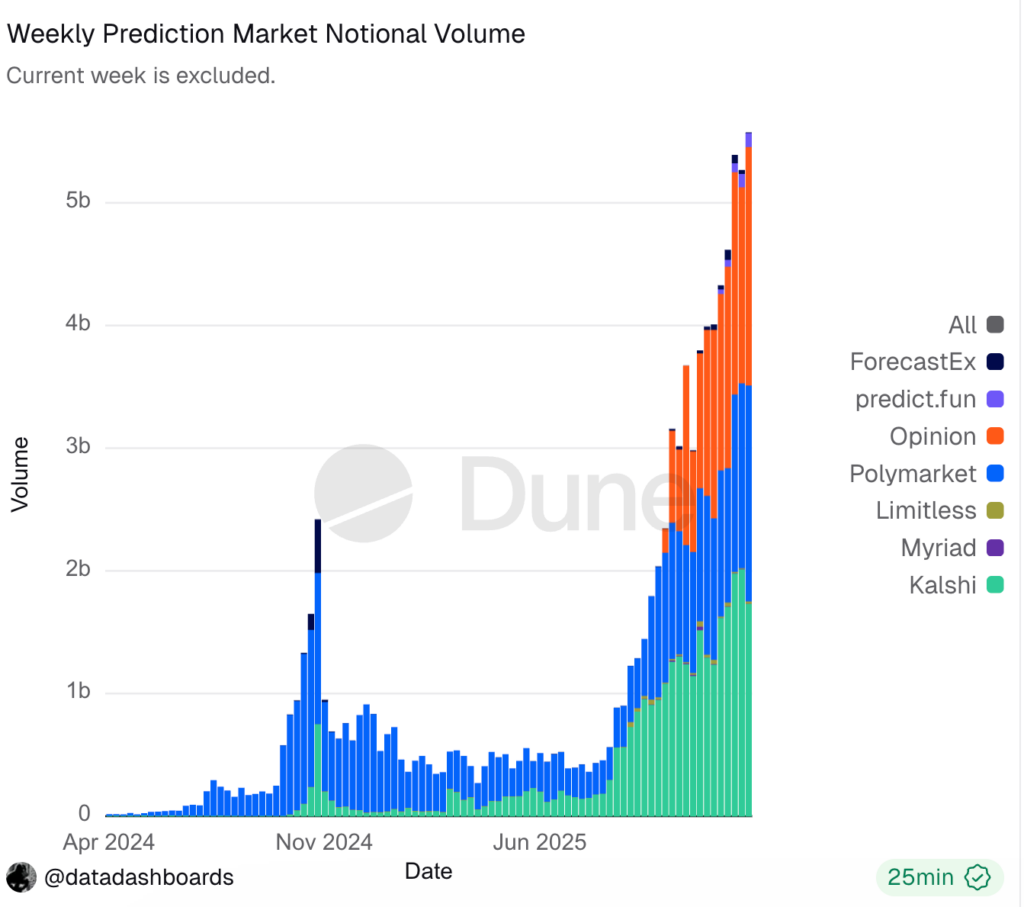

- Prediction markets hit a record $3.7B in weekly trading volume.

- Individual traders saw extreme outcomes, with both multi-million dollar wins and losses.

- Major institutions like Coinbase and Gemini are entering the market.

Prediction markets post record activity during the past week, confirming a sharp rise in event-based trading tied to politics, crypto assets, and sports. Trading data shows expanding participation and heavier capital flows, while uneven results among traders underline the high-risk profile of such platforms. The surge places prediction markets at the center of the current cryptofinancial cycle, even as structural concerns gain visibility.

On-chain analytics from Dune report weekly trading volume reaching $3.7 billion, the highest level recorded to date. Weekly notional volume climbs further, touching $5.57 billion. The figures extend a pattern that strengthens throughout 2025, when interest in outcome-based contracts begins to exceed activity seen in meme tokens and digital collectibles. Capital shifts toward products linked to verifiable events rather than narrative-driven assets.

User participation rises alongside volume. Weekly active addresses peak at 335,583 during the first week of January. Transaction counts follow a similar path, pointing to more frequent engagement rather than isolated large trades. Even so, activity clusters around a narrow set of themes. Political outcomes, sports results, and crypto-related events generate most of the volume on platforms such as Polymarket and Kalshi, leaving other categories thinly traded.

Individual trading records illustrate the uneven distribution of outcomes

Data shared by Lookonchain highlights a Polymarket user known as “beachboy4”, who reverses losses exceeding $6.8 million and reaches an estimated $395,000 profit after a series of successful sports wagers. Within two days, reported gains surpass $10.5 million, fully offsetting prior drawdowns. Bet sizes also expand, moving from hundreds of thousands of dollars to single positions above $3 million.

In just 2 days, beachboy4 has pulled off a stunning comeback — from over $6.8M in losses to about $395K in profit!

Over the past 2 days, he profited over $10.5M on 5 predictions, fully recovering his previous losses.

That said, his bet sizes have surged — from a few hundred… pic.twitter.com/rqM85bZLtu

— Lookonchain (@lookonchain) January 19, 2026

Two Polymarket users record combined losses close to $10 million in under a month after placing heavy bets on sports markets priced between 48 and 57 cents. One account posts a win rate near 46% across hundreds of predictions, losing almost $6 million in 24 days. Another shows a win rate slightly above 41%, with losses exceeding $4 million in just 11 days. At near-even odds, aggressive sizing accelerates capital erosion.

Don't place large directional bets at ~50¢ odds.

2 #Polymarket traders bet heavily on sports markets at 48¢–57¢, and lost nearly $10M in less than a month.

0x4924: 346 predictions, 46.24% win rate, -$5.96M in 24 days

bossoskil1: 65 predictions, 41.54% win rate, -$4.04M in 11… pic.twitter.com/s3Ynzi0YVf

— Lookonchain (@lookonchain) January 16, 2026

Coinbase prepares the launch of in-house prediction markets, according to industry reports. A Gemini-linked entity secures regulatory approval to offer similar products to U.S. users. Trump Media & Technology Group signals plans to enter the segment, while Fanatics rolls out a fan-driven prediction platform in partnership with Crypto.com. The influx of large brands increases visibility and competition across platforms.

The recent data confirms rapid expansion across prediction markets

Traders point to persistent liquidity constraints, with many newly created markets attracting minimal capital. Others raise concerns over insider trading. Recent episodes show wallets earning more than $630,000 by betting on political outcomes shortly before public announcements. Additional cases involve near-perfect accuracy on entertainment awards and corporate search data, results that challenge assumptions about fair access to information.

Record volumes, rising participation, and corporate entry define current conditions, while concentration, liquidity gaps, and information asymmetry remain unresolved. The sector advances through measurable activity, even as risks surface with equal clarity.