TL;DR

- Prediction markets attract large fintech platforms because they generate activity, volume, and fast fees; Robinhood, Coinbase, and Gemini are already moving forward through partnerships or in-house projects.

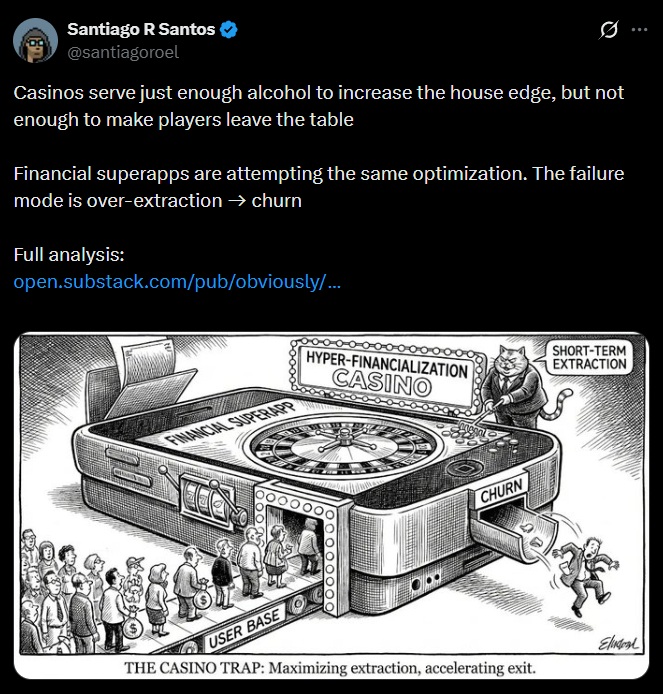

- These markets introduce a casino-style logic that strains the user relationship, accelerates churn, and turns each liquidation into a real, definitive exit.

- This expansion overlooks the cost to serve: more support and regulatory friction; cases like Nubank and Goldman show that adjacency outperforms speculative bets.

Prediction markets entered the agenda of large fintech platforms for a simple reason: they generate activity, volume, and fast commissions. Robinhood, Coinbase, and Gemini already have initiatives in the space, either through partnerships with Kalshi or through proprietary projects.

Prediction markets introduce casino-like dynamics into applications that, until now, sold simplicity, accessibility, and continuity. That shift is altering the relationship with users. It does not strengthen or extend the bond. It tightens it. The casino logic does not fail because a user loses money on a single trade. It fails because it accelerates churn. A liquidated user exits the system. A user who leaves is worth zero.

Clear Differences in Models and Markets

From a product perspective, the temptation is obvious. The same user who trades options or memecoins can also bet on a game or a political outcome. The behavioral overlap exists. But strategy is not defined by what is possible, but by what preserves value over time. Prediction markets maximize extraction during attention spikes and undermine long-term retention.

The most common mistake among financial superapps is obsessing over customer acquisition cost while underestimating cost to serve. Every new module introduces new problems and new needs to address: more support, more reviews, more regulatory conflicts. If a product increases volatility in user behavior, it also increases that hidden cost.

Adjacency vs. Speculation

There are clear examples. Nubank grew by adding boring but adjacent products: cards, credit, insurance. Revenue per user increased as trust deepened, not as speculation intensified. At the opposite end, Goldman Sachs failed when it tried to scale mass-market consumer finance with an incompatible structure. The issue was not demand. It was the mismatch between the product and the operating model.

Prediction markets promise engagement, but they come with regulatory, legal, and reputational problems. Several states are already questioning whether these contracts qualify as disguised gambling. That legal ambiguity is not a minor detail. It is a constant source of friction. Durable fintech platforms grow with their users. They capture more areas of their financial lives as those users mature. Prioritizing bets, binary events, and extreme outcomes points in the opposite direction. It does not build stability. It accelerates exits