TL;DR

- Ondo Finance launches Ondo Chain, a layer 1 blockchain aimed at connecting traditional capital markets with decentralized finance (DeFi).

- The blockchain implements institutional security through permissioned validators, protecting the network from threats like MEV.

- Ondo offers staking of tokenized assets and native bridges to improve interoperability between blockchains, in addition to facilitating the development of DeFi applications.

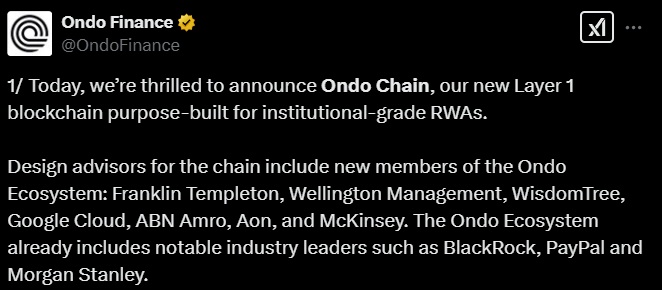

Ondo Finance has introduced Ondo Chain, a layer 1 blockchain designed to revolutionize the market for real-world assets (RWAs) and decentralized finance (DeFi).

Its main objective is to facilitate the connection between traditional capital markets and the DeFi ecosystem, providing infrastructure that meets the strict regulatory standards of financial institutions while maintaining the accessibility and transparency typical of public blockchains.

Ondo Chain: Institutional-Level Security

One of the key features of Ondo Chain is its institutional security. The blockchain is designed to operate with permissioned validators, ensuring constant supervision to protect the network from threats like Miner Extractable Value (MEV). This structure of supervised validators provides the necessary level of security to attract traditional financial institutions, which are sometimes limited in their participation in public blockchains due to risks related to data protection and fraud.

In addition to this security, Ondo Chain includes innovative tools like staking of tokenized assets. Users will be able to stake tokens like Ondo GM tokens, strengthening the network and allowing them to generate returns. Another important component is the inclusion of native bridges, which facilitate interoperability between different blockchains. This significantly reduces the costs and risks associated with using third-party bridge solutions.

More Tools for Developers

Ondo Chain is also designed to encourage the development of DeFi applications, enabling developers to create applications that natively support RWAs. This approach opens up new possibilities for the sector, such as lending, and strengthens the use of traditional assets within the DeFi ecosystem.

Scalability and connectivity with institutional networks are other important benefits. By using high-quality tokenized assets as collateral, the network achieves high levels of security at a relatively low cost.

With a focus on the tokenization of assets and the global expansion of decentralized financial markets, Ondo Chain has the potential to attract more financial institutions to the blockchain space.