TL;DR

- Over 220 companies now operate as crypto treasuries, raising capital to accumulate Bitcoin and other assets without using collateral.

- Of the $44 billion raised by 12 firms, only a third was debt-financed, and 87% of that debt is unsecured, according to Presto Research.

- Analysts warn that this growing concentration could undermine Bitcoin’s appeal as an institutional reserve, though systemic risk remains limited for now.

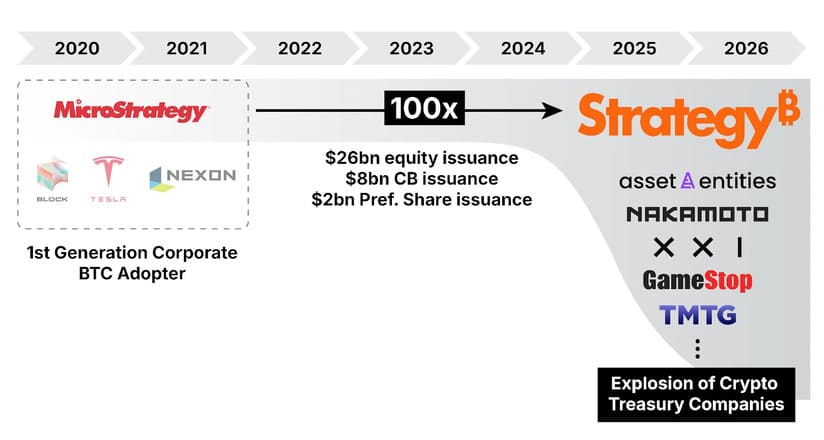

An increasing number of companies are adopting crypto treasury strategies, using capital markets to accumulate digital assets and take advantage of the sector’s volatility. This phenomenon, reminiscent of leveraged buyouts in the ’80s and the rise of ETFs in the ’90s, remains poorly understood outside the crypto ecosystem, according to a report by Presto Research.

Many of these firms, often former operating businesses, SPACs, or inactive companies, are raising funds through equity issuances, convertible bonds, or preferred instruments. Their goal is to expand their holdings in Bitcoin, Ethereum, and other cryptocurrencies without pledging those assets as collateral. Of the $44 billion raised or pending across 12 notable companies, only a third was debt-financed, with most of that debt unsecured.

Limited Risks, for Now

The report notes that the risk of forced liquidations through margin calls remains contained as long as these firms avoid backing loans with their crypto assets. While it doesn’t rule out asset sales in urgent liquidity situations, it estimates that systemic risk is lower than during previous cycles like Terra or Three Arrows Capital.

Another concern involves activist funds potentially pressuring these companies to liquidate their positions if their shares trade at steep discounts to net asset value. However, in practice, such investors tend to favor less drastic measures like buybacks or public tenders.

Could the Strategy Model Reshape the Crypto Market?

The model popularized by Strategy continues to expand, with over 220 firms now pursuing Bitcoin accumulation strategies. Recently, companies like Twenty One, Trump Media, and GameStop have adopted this approach.

Analysts caution that if corporate concentration persists, Bitcoin’s appeal as an institutional reserve could diminish. However, as long as these firms manage liquidity carefully and maintain financial discipline, they’re unlikely to pose a structural threat to the market. In parallel, Proof-of-Stake tokens are gaining traction for similar strategies, driven by staking rewards that can enhance asset growth