Nasdaq Inc. is making its first major push into the cryptocurrency market with the launch of a digital assets business aimed at tapping institutional investors. Initially, it will start offering crypto custody services to institutional clients.

The second-largest stock exchange prepares to capitalize on the increasing appetite for digital currencies among big-money investors. As per reports, Nasdaq has unfurled a new unit focusing on digital assets and will start by offering Bitcoin (BTC) and Ether (ETH) custody services for institutions.

NEW: Nasdaq's new digital assets group will initially offer custody services for Bitcoin and Ether to institutional investors, in a major push into crypto https://t.co/ieiLHZPfE8

— Bloomberg Markets (@markets) September 20, 2022

Nasdaq’s Dedicated Digital Assets Unit

The new unit, “Nasdaq Digital Assets”, will be headed by, Ira Auerbach, who previously led prime broker services at crypto exchange, Gemini. With this move, the premier stock exchange will compete with crypto firms such as Coinbase, Anchorage Digital, and BitGo. However, the new institutional custody offering is pending approval from the New York Department of Financial Services.

Auerbach explained that crypto custody services are independent storage and security systems for cryptocurrencies. Cryptocurrency custody can serve as vital support for expanding crypto holdings. He emphasized the growing interest of institutional investors in the crypto space establishes the need for institutional custody solutions. Auerbach added,

“We believe this next wave of the revolution is going to be driven by mass institutional adoption. I can think of no better place to bring that trust and brand to the market than Nasdaq.”

Welcome Nasdaq to crypto! 🤝

» Nasdaq To Launch Institutional Bitcoin, Crypto Custody Services: Report | Nasdaq https://t.co/2SOXofSzcz

— CZ 🔶 Binance (@cz_binance) September 20, 2022

Why are Crypto Custody Services Important?

Tal Cohen, Nasdaq’s executive vice president and head of North American markets, specified, “Custody is foundational”. He went on to add crypto custody services are important as it focuses on taking responsibility for the digital assets of customers and securing them. The institutional crypto custody solutions hold the private keys to assets on behalf of the owner. The custody solution ensures that any other party would not access the private keys of a user.

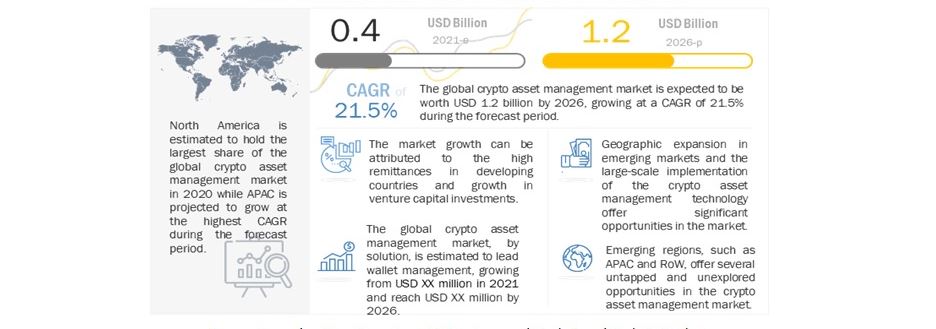

The crypto custody market size has been estimated to grow at a 21.5% CAGR to reach $1.2 billion by 2026. Around 150 active crypto-related hedge funds have already accumulated almost $1 billion in terms of the value of assets under their management. However, around 52% of hedge funds, financial institutions, and high net worth individuals depend on services of independent custody solutions.

In a report, accounting giant, PricewaterhouseCoopers stated,

“The offer of Crypto Custody services becomes fundamental to meet the needs of the various market stakeholders interested in using crypto services and to capture the new business opportunities of a market with ample room for growth.”