TL;DR

- Morpho launched V2, a new version that enables fixed-rate, fixed-term loans and custom conditions without fragmenting liquidity.

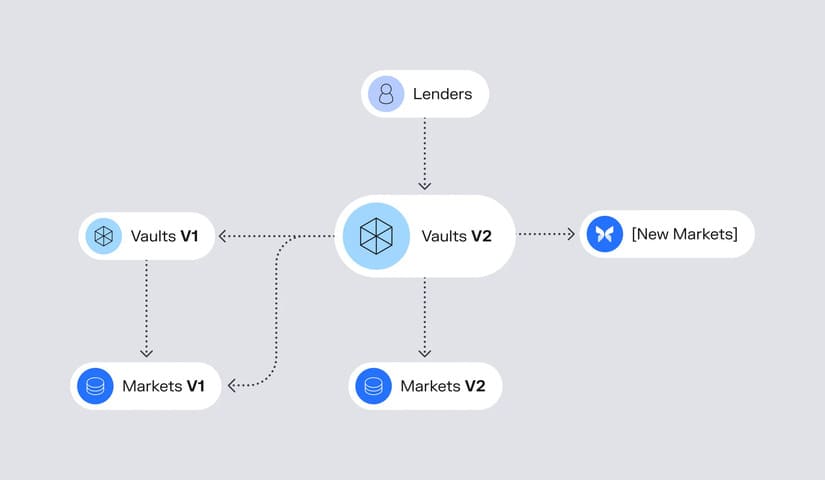

- The system introduces Markets V2, which allows peer-to-peer loan negotiation without relying on preset pools, and Vaults V2, featuring profitable, manageable vaults.

- V2 adopts market-defined pricing, removes KYC-based liquidity fragmentation, and lets users operate loans across multiple networks with unified liquidity.

Morpho introduced its new onchain lending protocol version, designed to address the scalability and flexibility limitations that have held back traditional decentralized platforms. Under the name V2, this system brings fixed-rate, fixed-term loans and a modular architecture that allows users to customize conditions without splitting liquidity.

Morpho: Markets & Vaults

The launch includes two key components. First, Morpho Markets V2 operates as a peer-to-peer marketplace where borrowers and lenders can negotiate specific loan terms. Unlike earlier models, this system lets users offer liquidity without locking capital into predetermined pools.

Users can structure loans backed by a single asset, multiple collateral types, or complete portfolios, including real-world assets. It also allows defining custom price oracles, collateralization levels, and verification requirements.

The second component, Morpho Vaults V2, enables users to create vaults that invest in various protocols to generate yields. These vaults offer instant liquidity, with either variable returns or fixed rates, and remain compatible with earlier protocol versions. They also introduce advanced risk management tools, such as absolute and relative exposure limits on specific assets or price sources, making it easier to design tailored investment strategies.

One of Morpho V2’s standout features is its market-based pricing system. Unlike protocols that rely on fixed formulas to calculate rates, this system lets offers directly set the terms of each loan. This makes it possible for rates to adjust dynamically based on actual supply and demand, improving the system’s efficiency.

Solving Compatibility and Liquidity Challenges

The protocol also addresses onchain compliance issues without dividing liquidity between verified and unverified assets. A single market can serve borrowers with different KYC requirements, avoiding fragmented versions of the same asset. Additionally, V2 incorporates crosschain compatibility, allowing users to offer and settle loans across different networks while maintaining shared liquidity.

Morpho confirmed that the rollout will happen in phases, starting with Vaults V2, which has already completed security audits, followed by Markets V2, currently undergoing review