TL;DR

- Mirae Asset Global Investments and Ctrl Alt are developing tokenized funds in the UAE, with on-chain issuance, management, and financial operations.

- The project relies on Ctrl Alt’s regulated infrastructure and on the scale of Mirae Asset, a global asset manager with more than $353B under management and operations in Korea and India.

- The initial phase will cover funds domiciled in the UAE, with on-chain issuance, custody, and settlement, and is evaluating an expansion to other regulated GCC markets.

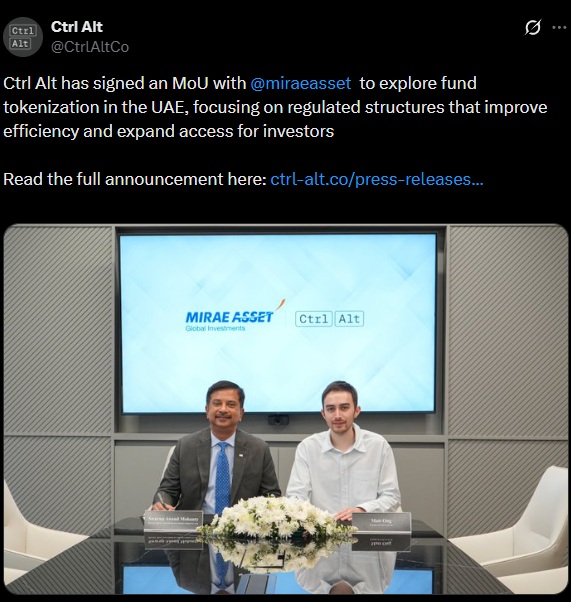

Mirae Asset Global Investments and Ctrl Alt have launched a collaboration to develop tokenized investment funds in the United Arab Emirates, using existing regulatory frameworks for the issuance, administration, and operation of on-chain financial products.

The project is built on Ctrl Alt’s regulated infrastructure in the UAE and on Mirae Asset’s operational capacity, as a global asset manager with more than $353B in assets under management and a presence in Korea and India.

The first phase of the work will focus on funds domiciled in the UAE. Its scope includes the design of legal and operational structures that enable the issuance of tokenized fund units, their custody, investor management, and the settlement of transactions on blockchain infrastructure. Both parties are assessing an extension of the model to other regulated financial markets within the Gulf Cooperation Council.

Ctrl Alt Will Provide Its Tokenization Infrastructure

Ctrl Alt will contribute its end-to-end tokenization infrastructure for the minting, issuance, and on-chain management of funds. The system integrates processes such as investor onboarding, subscriptions, redemptions, and capital calls through smart contracts. Execution remains within local regulatory environments, with compliance controls and governance aligned with current financial regulations.

Mirae Asset Will Contribute Its Expertise and Institutional Network

Mirae Asset will use its product structuring expertise, institutional network, and regional presence to pilot the first tokenized funds. The framework includes products aimed at both institutional and retail investors, with the operational objective of expanding access to investment vehicles that traditionally carry high entry barriers.

Interest in fund tokenization is developing within a region experiencing rapid market expansion. Industry projections estimate that the Middle East digital asset market could reach $600B by 2030, driven by tokenization, asset fractionalization, and increasing participation from banks and family offices.

Ctrl Alt already has an operational track record in the UAE. In May 2025, the company was selected as the tokenization partner of the Dubai Land Department for a real estate tokenization program on the XRP Ledger, developed alongside VARA, the Dubai Future Foundation, and PRYPCO. That initiative targets the creation of a tokenized real estate market valued at AED 60B, equivalent to $16B, by 2033, representing close to 7% of Dubai’s total property transactions