TL;DR

- MicroStrategy is facing tax issues over unrealized gains from its BTC, despite not having sold any.

- The Inflation Reduction Act of 2022 imposes a 15% corporate minimum tax, which would affect unrealized gains from cryptocurrencies like Bitcoin.

- The company may be forced to sell part of its Bitcoins to pay taxes, which would affect its accumulation strategy.

MicroStrategy, the company known for being the largest holder of Bitcoin in the world, is facing a serious tax issue related to the unrealized gains from its cryptocurrency investments. Despite not having sold a single Bitcoin, the company could be forced to pay taxes on the gains generated by the increase in the value of its BTC.

The potential tax liability stems from the Inflation Reduction Act, passed in 2022, which imposes a 15% corporate minimum tax on companies exceeding certain adjusted income thresholds.

MicroStrategy falls within the scope of this legislation, as it holds over 450,000 BTC, worth more than $48 billion. According to the new tax rules, the tax would apply not only to realized gains from asset sales but also to unrealized gains from cryptocurrencies, creating a significant uproar.

MicroStrategy: The End of Constant Accumulation?

This scenario has caught the attention of tax analysts, who argue that although unrealized gains from cryptocurrencies like Bitcoin were not previously taxed, the new IRS regulations could change the situation. While exemptions exist for other types of assets, such as stocks, cryptocurrencies do not currently have a similar exemption. This puts MicroStrategy in a delicate position, as it may have to sell part of its Bitcoins to pay the tax, directly affecting its accumulation strategy.

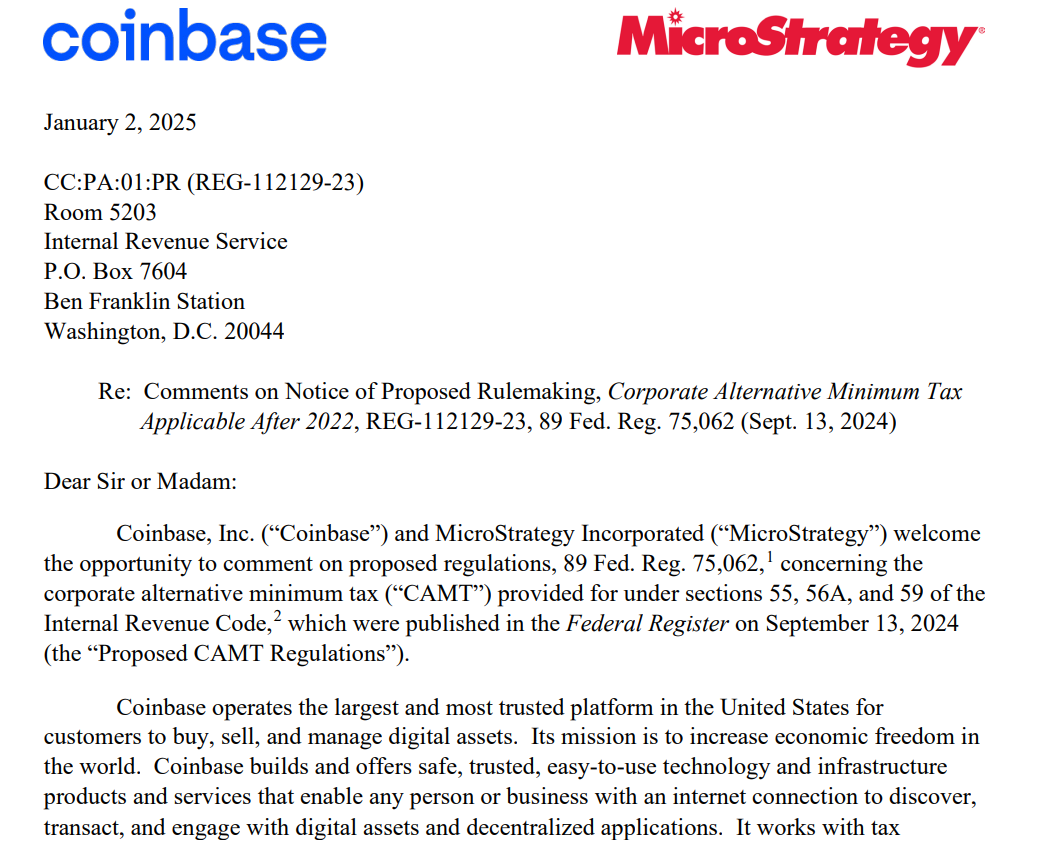

The company’s future heavily depends on how the new tax rules unfold. MicroStrategy and Coinbase have requested the IRS to adjust the rules to exclude unrealized gains from cryptocurrencies, arguing that this could negatively impact companies with large amounts of digital assets.

If the IRS does not amend the rules, the company will have to deal with very high taxes, which could force it to sell assets to cover the payments. Therefore, the uncertainty is sky-high