TL;DR

- Metaplanet added 463 BTC for $53.7 million and now holds 17,795 units, aiming to reach 210,000 BTC by 2027.

- It plans to issue $3.7 billion in preferred shares between 2025 and 2027 to sustain its purchases, with a 6% dividend priority over common shareholders.

- Its strategy has delivered a 170% BTC return year-to-date and a 175% increase in its stock, despite a 36% drop over the past month.

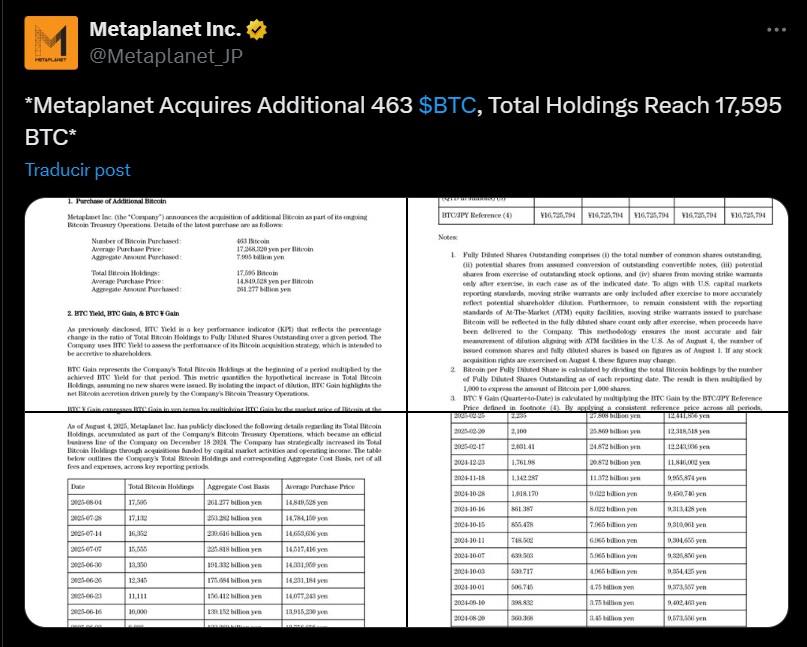

Metaplanet has added 463 bitcoins to its reserves for a total of $53.7 million, at an average price of $115,895 per unit. With this purchase, the Japanese company brings its total holdings to 17,795 BTC as it moves toward its goal of accumulating 210,000 BTC by 2027.

The plan includes reaching 30,000 BTC by the end of this year and surpassing 100,000 units in 2026. Listed on the Tokyo Stock Exchange, the firm has built its strategy around regular bitcoin acquisitions as the core asset in its treasury.

To maintain its pace of purchases, Metaplanet is seeking to issue preferred shares worth 555 billion yen, or $3.7 billion. The issuance will be spread out in tranches from August 2025 to August 2027 and includes the creation of two new classes of perpetual preferred shares, Class A and Class B, with dividend priority of up to 6% over common stockholders.

Metaplanet Stock Has Risen 175% in 2025

The company aims to increase its authorized capital to $2.723 billion, which would give it more flexibility for future fundraising. The proposal will be voted on at an extraordinary general meeting scheduled for September 1.

Between July 1 and August 4, Metaplanet reported a 24.6% return in BTC, bringing its year-to-date BTC return to 170%. The company uses metrics such as “BTC Yield” and “BTC Yen Gain” to track the impact of its strategy both in bitcoin and yen terms, with the goal of maximizing BTC per share. Its bitcoin operations have driven a 174.7% rise in its stock value so far this year, though the share price dropped 36.14% over the past month.

In addition to continuing its bitcoin purchases, Metaplanet plans to use part of its reserves as collateral to finance acquisitions of steady cash-generating businesses, such as financial service providers or digital banking firms. According to its president, Simon Gerovich, the goal is to turn BTC holdings into a tool for expansion without selling them or relying on convertible debt