TL;DR

- In the last 24 hours, crypto markets saw $424.55 million in liquidations, affecting over 121,800 traders.

- Long positions dominated the wipeout, with $248.44 million lost, exposing bullish overconfidence.

- The largest single liquidation was a BTC/USDT long on HTX, showing how sudden reversals continue to catch leveraged traders off guard during high volatility.

Crypto markets experienced a sharp downturn, triggered by global uncertainty and investor risk-off sentiment. A total of $424.55 million was liquidated within a single day, impacting 121,839 traders. Most of the damage came from long positions, which accounted for $248.44 million of the total, indicating that the majority of participants expected upward momentum—and were wrong.

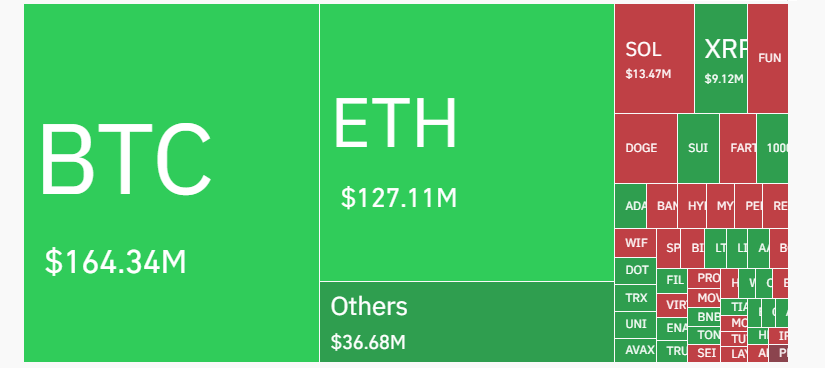

Bitcoin led the losses with $164.34 million in liquidations, followed by Ethereum at $127.11 million. Other altcoins combined for $36.68 million in wiped-out value. The largest individual liquidation was a BTC/USDT long position on the HTX exchange ($35.45M).

Many of the affected traders used high leverage, amplifying the impact of relatively modest price swings. This pattern highlights the importance of proper risk management, especially during periods of geopolitical tension and uncertain macroeconomic signals.

Volatility Signals May Point To A Short-Term Bounce

With the “Fear & Greed Index” dropping below 40, traders are showing signs of anxiety. Technical indicators suggest exhaustion in the current sell-off: the RSI has dipped below 40, and Bollinger Bands were breached, pointing to a possible relief rally. However, market cap continues to stay below the 20-day SMA of $3.23 trillion, which keeps bearish momentum intact.

Bybit saw the highest liquidation volume among exchanges, while Binance and Gate followed with substantial outflows. Notably, long-liquidation ratios remained elevated across major platforms like Bitmex and CoinEx, exceeding 90% in some cases. This trend shows a heavy tilt toward bullish positioning that failed to withstand the latest wave of downward pressure.

Bitcoin Dominance Rises While Altcoins Struggle

Bitcoin’s dominance surged to 64.9%, signaling a retreat from riskier altcoins. Ethereum’s market share slipped to 8.7%, and other Layer 1 tokens underperformed broadly. Even so, select microcaps continued to see speculative inflows. Story IP gained 11.35%, Four rose 10.39%, and Sonic added 7.68%, proving that pockets of activity still thrive despite broader corrections.

Despite the sell-off, many analysts remain optimistic about long-term crypto adoption. They point to strong institutional interest, ongoing regulatory developments, and upcoming blockchain upgrades as key factors that could drive the next leg of growth once market conditions stabilize.