TL;DR

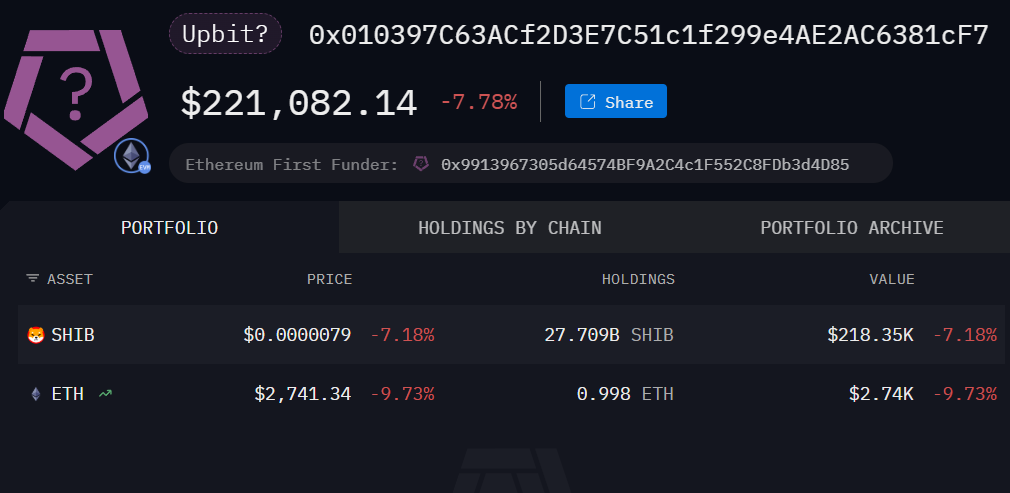

- The transfer of 389,999,999,999 SHIB from an Upbit wallet to an active address that has been moving memecoins across multiple exchanges was recorded.

- The receiving wallet redistributed multiple batches of 30–40 billion SHIB to various platforms, keeping the token price stable around $0.0000079.

- Analysts indicate that these massive movements could signal upcoming liquidity shifts, arbitrage strategies, or preparations by large holders for market fluctuations.

The transfer of 389,999,999,999 Shiba Inu (SHIB) from a wallet of the South Korean exchange Upbit to an address that has been moving large amounts of memecoins across multiple exchanges throughout the day was recorded.

The receiving address is not a cold wallet but an active wallet that receives funds from Upbit, sends them to Binance, and interacts with other wallets before redistributing them again. The transfer pattern suggests these are not simple internal adjustments by the exchange but strategic liquidity movements across platforms.

SHIB Maintains Stability Despite Massive Transfers

In the following hours, the wallet sent multiple batches of SHIB ranging from 30 to 40 billion tokens to different destinations at short intervals. The token price remained stable around $0.0000079, so the activity did not have an immediate market impact. However, the total volume transferred, close to $3.3 million, adds a new entry to SHIB’s distribution in December and marks a shift compared to previous weeks, when deposits to centralized exchanges dominated the market.

The magnitude and coordination of these transfers suggest that SHIB’s liquidity could be redistributed in preparation for upcoming changes in market conditions. Alternatively, it could involve a large holder reorganizing their supply before re-engaging with the market.

What Analysts Say

Tracking these transfers allows for the identification of potential arbitrage strategies or liquidity movements that could affect specific exchanges in the coming days. Market analysts note that the activity of wallets interacting across multiple platforms provides early signals on how large quantities of tokens are distributed in a fragmented and highly liquid market.

Moreover, the massive flow of SHIB to and from different platforms highlights the importance of operational coordination between exchanges to maintain efficient fund management. Analysts suggest that such movements could anticipate new trading opportunities or prepare large holders to react to volatility changes without causing immediate disruptions in the memecoin’s price