TL;DR

- Polygon implemented the Madhugiri hard fork, which reduces consensus time to one second and boosts the network’s capacity by 33%.

- The upgrade adds three Fusaka-series EIPs that cap gas in heavy operations and introduces a new transaction type for the bridge.

- The goal is to strengthen support for stablecoins and RWAs, and it follows the hard fork that fixed finality issues after the rollout of Heimdall 2.0.

Polygon activated the Madhugiri hard fork to increase its network capacity and remove constraints that were slowing high-frequency use cases.

What Changed?

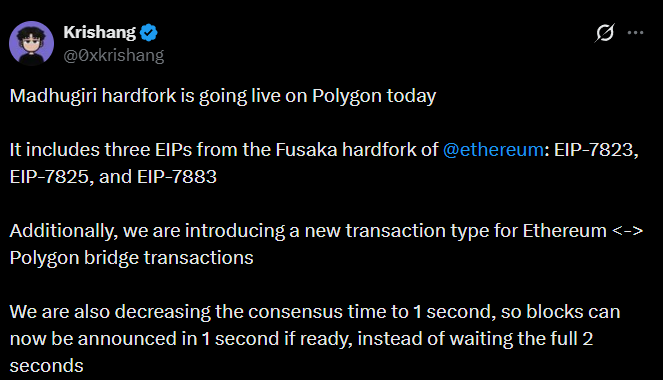

The upgrade cuts consensus time to one second, introduces technical improvements from three Fusaka-series EIPs and enables a more flexible structure for future performance adjustments. With this shift, the network aims to move toward an ecosystem built for stablecoins, RWAs and applications that require speed and predictable block behavior.

The most visible change is the reduction in the time the network waits before announcing a block. It previously had to pause for two seconds even when a block was already prepared; now it can publish it in one second, shortening consensus cycles and increasing overall throughput. The team estimates that network performance can rise by roughly 33%. The update also introduces a new transaction type for traffic between Ethereum and Polygon, allowing better ordering of bridge flows and preventing overload in processing.

Madhugiri integrates EIP-7823, EIP-7825 and EIP-7883, which limit gas usage in heavy mathematical operations. This prevents a single transaction from consuming more resources than necessary and stabilizes network behavior under high demand. The objective is to achieve more uniform performance, with more predictable blocks and less sensitivity to complex operations.

Polygon Prepares for a Wave of Stablecoins

Polygon is adapting to sustain its growth in the stablecoin and real-world asset markets. Aishwary Gupta, global head of payments and RWAs, expects around 100,000 stablecoins to launch in the next five years and argues that this expansion requires infrastructure capable of providing auditing, settlement and real utility, not just issuance. His view is that current metrics lose meaning if the underlying assets cannot be verified, and that transparency will be the catalyst that brings in large-scale institutional capital.

Madhugiri arrives after a series of deeper improvements. Heimdall 2.0 reduced transaction finalization from more than a minute to about five seconds. However, a bug in September caused delays of 10 to 15 minutes and forced another hard fork to restore validator synchronization and finality. With those fixes now in place, Polygon is using Madhugiri to stabilize its progress and prepare the ground for the next phase of expansion