TL;DR

- According to attorney Bill Morgan, the SEC v. Ripple litigation is legally closed on its core points.

- In July 2023, Judge Analisa Torres ruled that XRP does not constitute an investment contract, which removed the basis for claims related to programmatic sales and secondary market transactions.

- The SEC only retains limited room to pursue claims over sales made after 2020, but any future action is constrained by the final ruling and cannot redefine the nature of the token.

The litigation between the SEC and Ripple is legally closed on its central issues and cannot be reopened under the same arguments, according to attorney Bill Morgan, one of the legal analysts who followed the case consistently. The key factor is the application of the principle of res judicata, which prevents parties from relitigating matters already resolved through a final judgment.

According to Morgan, claim preclusion blocks any new attempt by the SEC to argue that XRP is a security and also invalidates claims related to Ripple’s historical XRP sales conducted between 2013 and 2020. Those issues were already examined and decided by the U.S. federal courts and cannot be reintroduced in a new proceeding.

Rulings on the Definition of XRP

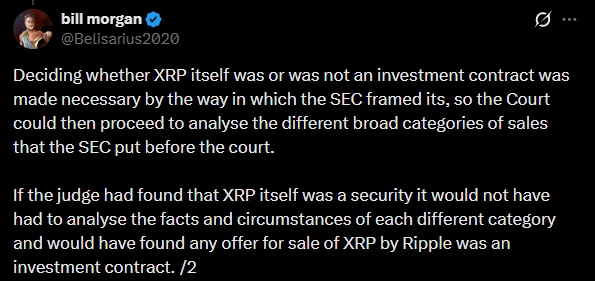

The origin of this situation lies in the strategy adopted by the SEC during the trial. The agency divided Ripple’s activity into several categories: institutional sales, programmatic sales on secondary markets, and other forms of distribution. At the same time, it argued that XRP, as an asset, constituted an investment contract.

That approach required the court to first rule on the legal nature of XRP itself. In July 2023, Judge Analisa Torres determined that XRP, on its own, is not an investment contract. Based on that definition, the court then evaluated each type of sale separately and issued different conclusions depending on the context of the transaction.

As a result, the SEC lost its claims related to programmatic sales and secondary market transactions. It only secured an adverse ruling for Ripple in the case of certain institutional sales. Morgan emphasized that the SEC did not appeal the central finding that XRP is not a security, which ultimately fixed that standard for future litigation.

Could the SEC Initiate New Actions Against Ripple?

The principle of res judicata includes both the prohibition on reopening claims and the inability to relitigate issues already resolved. This directly limits any future SEC action related to XRP sales carried out before 2020.

According to Morgan, the regulator still retains a narrow margin of action. It could bring claims related to XRP sales or distributions conducted after 2020, but any new case would be constrained by the 2023 ruling and could not challenge the nature of the token again.

The possibility of reopening the case under a different framework would only exist in the event of an explicit legal change, such as the passage of a new law by the U.S. Congress with presidential approval. Until that happens, the core elements of the Ripple case will remain legally closed