TL;DR

- Analysts leaked allegations linking the Kadena team to internal manipulation, insider trading, and financial fraud.

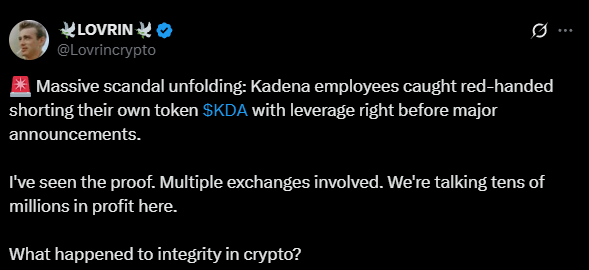

- Some employees allegedly opened leveraged short positions against KDA before the shutdown.

- The network will continue operating in a decentralized manner, but the scandal has severely damaged trust in Kadena.

Kadena confirmed the closure of its operations after a collapse that sent KDA’s price plunging by more than 60% within hours. The announcement triggered a massive sell-off and led to a wave of allegations pointing to internal manipulation, mismanagement, and potential fraud within the project.

Allegations of Fraud and Manipulation

According to analyst Lovrin, several Kadena employees allegedly opened leveraged short positions against the token shortly before the shutdown announcement, securing tens of millions of dollars in profits. Reports suggest that certain crypto exchanges facilitated these trades, raising suspicions of coordination between team members and external actors.

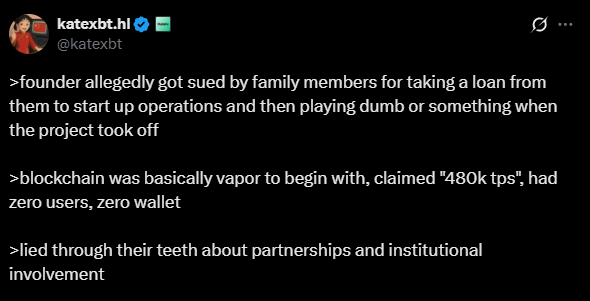

Hours later, analyst @Katexbt released further accusations that intensified the scandal. She claimed that Kadena founders Stuart Popejoy and Will Martino were sued by family members over a personal loan used to fund the company, casting doubt on its financial transparency from the very beginning.

She also pointed out that the network was marketed as capable of processing 480,000 transactions per second but lacked real users and active wallets. Her findings suggest that many institutional partnerships were exaggerated or fabricated to sustain a narrative of growth and adoption.

The leaks also revealed internal conflicts and opaque links between Kadena and affiliated entities. The Kaddex domain, a product within the ecosystem, was reportedly registered under Popejoy’s family golf club in Italy. Other testimonies indicate that the leadership hired a marketing agency but failed to pay for its services, prioritizing the sale of tokens for cash instead.

The Kadena Scandal Delivers a Blow to Market Confidence

The case also implicates Francesco Melpignano, former CEO of Kadena Eco, who allegedly helped extract and sell large amounts of KDA near peak prices, earning an estimated $20 million to $80 million in profits. Although the community reportedly ousted him, sources cited by @Katexbt claim he remains on the payroll of a shell company tied to the same circle.

In its official statement, Kadena said the decision to shut down stemmed from unfavorable market conditions and clarified that the blockchain will continue to function independently under a decentralized model. The network will keep 566 million KDA allocated for mining rewards until the year 2139 and will release an additional 83.7 million tokens by November 2029. However, the allegations have left the company mired in one of the most serious trust crises in the crypto sector