TL;DR

- According to K33 Research, BlackRock drives inflows in Bitcoin ETFs, preventing spot ETFs from registering net outflows.

- The absence of BlackRock in future altcoin ETFs could limit total inflows and reduce the positive impact on underlying asset prices.

- Analysts estimate that the first Solana and XRP ETFs could attract between $3 billion and $8 billion.

BlackRock remains the main driver of flows in Bitcoin ETFs, and its hypothetical absence raises questions about actual performance.

K33 Research: No BlackRock, No Party

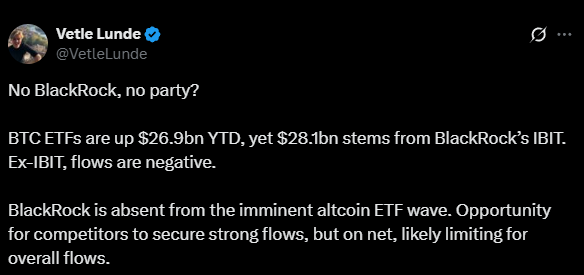

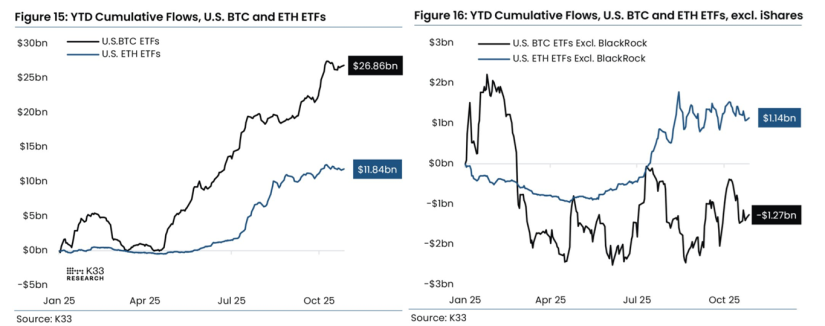

K33 Research reports that BlackRock’s iShares Bitcoin Trust received $28.1 billion in 2025, the only fund with positive year-to-date inflows, allowing spot Bitcoin ETFs to close the year with a cumulative net inflow of $26.9 billion. Without BlackRock’s participation, Bitcoin ETFs would have seen net outflows of $1.27 billion.

This dependence shows that crypto ETF performance remains concentrated among major asset managers. Vetle Lunde, head of research at K33, warned that the approval of altcoin ETFs might not generate the expected inflows without the firm’s involvement. “No BlackRock, no party,” Lunde wrote, noting that its absence limits the potential of total inflows and the positive impact on underlying asset prices.

The Potential of Altcoin ETFs

However, some analysts foresee strong market interest in the next generation of ETFs. The first Solana staking ETF could attract up to $6 billion in its first year, according to Ryan Lee, chief analyst at Bitget.

JPMorgan estimates that a Solana ETF could draw between $3 billion and $6 billion, and an XRP ETF between $4 billion and $8 billion, based on the initial adoption of Bitcoin and Ethereum ETFs. In their first six months, Bitcoin ETFs achieved a 6% adoption rate, equivalent to 6% of BTC’s market capitalization, while ETH ETFs reached 3%.

Positive inflows from Bitcoin ETFs have been the main driver of the cryptocurrency’s price in 2025, according to Geoff Kendrick, Standard Chartered’s global head of digital assets research. This confirms that, despite the growing supply of crypto investment products, the presence of large-scale firms remains crucial to maintaining market appeal and liquidity.

K33 has identified a potential challenge for future altcoin ETFs aiming to capitalize on institutional interest. Without BlackRock’s participation, capital inflows could be limited and concentrated, affecting these products’ ability to drive altcoin prices