TL;DR

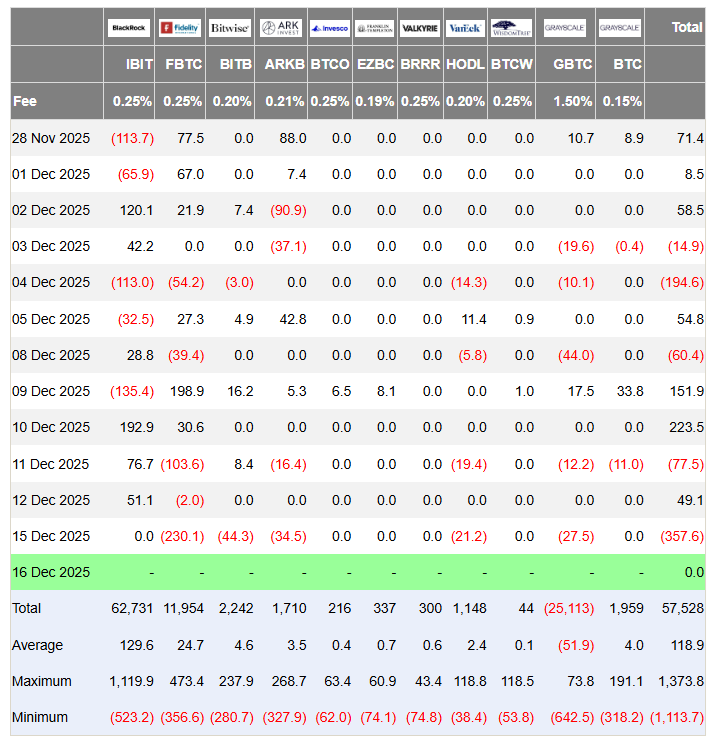

- Spot Bitcoin ETFs recorded net outflows of $357.7 million, led by Fidelity, reflecting a defensive repositioning amid a fragile macro backdrop.

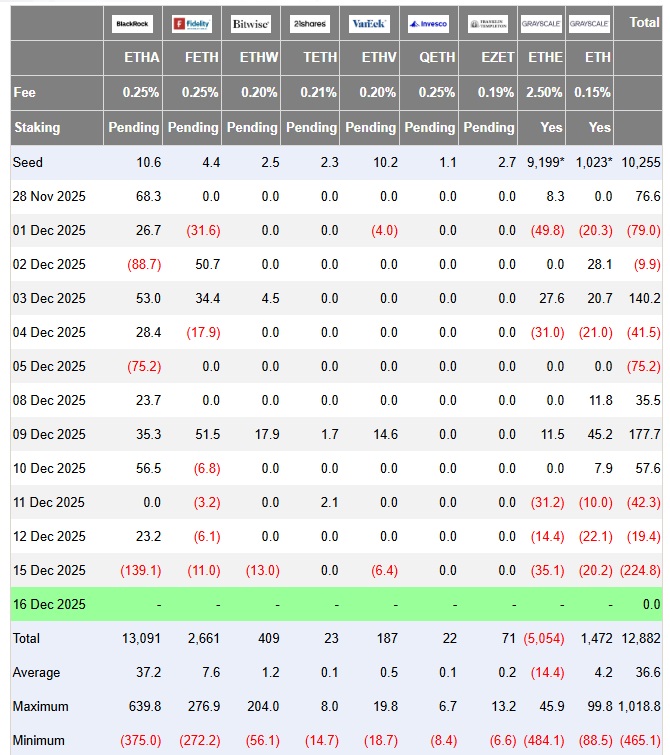

- Spot Ethereum ETFs posted $224.8 million in outflows, marking their largest single-day withdrawal since November.

- In contrast, spot XRP ETFs surpassed $1 billion in cumulative inflows. Solana funds attracted $35.2 million in new inflows.

Spot Bitcoin and Ethereum ETFs saw heavy capital outflows amid another leg down in prices and a deterioration in risk appetite.

On Monday, Bitcoin-linked funds recorded net withdrawals of $357.7 million, the largest daily negative flow since Nov. 20, when outflows exceeded $900 million. The capital exit points to a clear shift in investor positioning, with exposure being reduced in response to a more fragile macro environment.

Bitcoin Continues to Slide

Fidelity led the outflows, with $230.1 million exiting its FBTC ETF. Bitwise followed with $44.3 million in withdrawals from BITB, while products from Grayscale, Ark & 21Shares, and VanEck also ended the session with negative flows. The pressure was not concentrated in a single issuer but spread across the main Bitcoin investment vehicles.

Spot Ethereum ETFs showed a similar pattern. On Monday, they recorded net outflows of $224.8 million, their largest daily withdrawal since Nov. 20. The defensive adjustments were not limited to Bitcoin and extended to major digital assets, as investors rebalanced their portfolios more conservatively.

XRP and Solana Break the Negative Trend

In contrast, US spot XRP ETFs surpassed $1 billion in cumulative inflows after adding $10.89 million in net inflows during the same session. Funds from Canary, Grayscale, and Franklin Templeton accounted for the new allocations. Since the launch of the first spot XRP ETF on Nov. 13, demand for the product has pushed cumulative inflows to that threshold. Spot Solana ETFs also attracted capital, with $35.2 million in inflows and cumulative inflows reaching $711.3 million since their launch in October.

Bitcoin’s price weakened again. According to the latest data from CoinMarketCap, BTC fell by around 3.5% to roughly $85,500, hovering near its lowest level in two weeks and still close to the seven-month low set in late November. The decline coincided with weakness in technology stocks, where profit-taking in the artificial intelligence segment reduced overall risk tolerance.

Markets remain focused on upcoming US data. November nonfarm payrolls and the consumer price index will shape expectations around monetary policy. Employment and inflation remain the Federal Reserve’s two core variables. Cooling in either could open room for a rebound in assets most sensitive to the cost of capital, including Bitcoin.