TL;DR

- Multiliquid and Metalayer Ventures launched an institutional liquidity vehicle on Solana that enables the redemption of tokenized RWAs and the receipt of stablecoins.

- The vehicle is raised and managed by Metalayer Ventures, which acts as a standing buyer and uses Multiliquid’s smart contracts.

- The structure supports RWAs from asset managers such as VanEck, Janus Henderson, and Fasanara, and targets the release of locked liquidity in private credit, real estate, and alternative funds.

Multiliquid and Metalayer Ventures launched an institutional liquidity tool to enable the instant redemption of tokenized real-world assets on the Solana network. The vehicle allows onchain positions to be converted into stablecoins immediately, without relying on issuer-controlled redemption windows.

The facility is raised and managed by Metalayer Ventures, while Multiliquid provides the smart contract infrastructure used for pricing, settlement, interoperability, and compliance enforcement. The capital operates as a standing buyer of tokenized RWAs and executes purchases at a dynamic discount relative to net asset value.

Metalayer and Multiliquid Break the Bottleneck in the RWA Market

This structure targets an operational bottleneck that limits institutional use of tokenized assets, particularly outside the Treasury market. Tokenized private credit, private equity, and real estate products retain closed liquidity structures, even when marketed as cash-like instruments. Conversion into liquid capital often takes days or weeks.

The new vehicle allows users to sell their tokens at any time and receive stablecoins instantly, 24 hours a day. Metalayer manages the capital backing redemptions and assumes the role of counterparty, while Multiliquid executes the onchain logic that determines pricing, verifies regulatory conditions, and settles transactions.

In the initial phase, the facility will support assets issued by managers such as VanEck, Janus Henderson, and Fasanara. Tokenized Treasury funds and a selection of alternative products are also included. The capital will be deployed through audited smart contracts, and liquidity providers will be compensated for offering permanent availability.

Solana Still Has Significant Ground to Cover

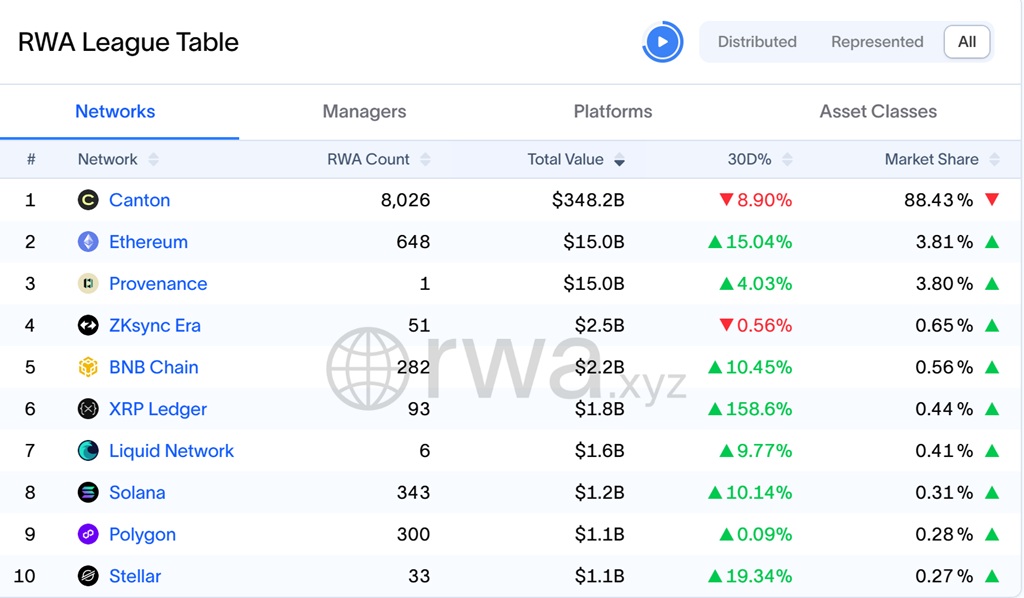

The launch coincides with the growth of the tokenized RWA market on Solana, which already exceeds $1 billion in value. The network hosts more than 300 assets and shows double-digit monthly growth, although its market share remains below 1%.

Canton Network leads the market with more than $348 billion in RWAs, followed by Ethereum and Provenance, each with around $15 billion. In that context, the Multiliquid and Metalayer facility introduces a dedicated liquidity layer that operates as redemption infrastructure, separate from issuers and aligned with continuous onchain flows.

The vehicle was designed to scale and extend to other markets, and discussions are underway to integrate it with Solana DeFi protocols that would allow exits from RWA positions.