TL;DR

- Hyperliquid Labs unstaked 1.2 million HYPE tokens to begin team vesting on January 6, which will introduce new supply into the market on a gradual basis.

- The released tokens, valued at $31.2 million, are part of a plan that will allocate 237 million HYPE to the team.

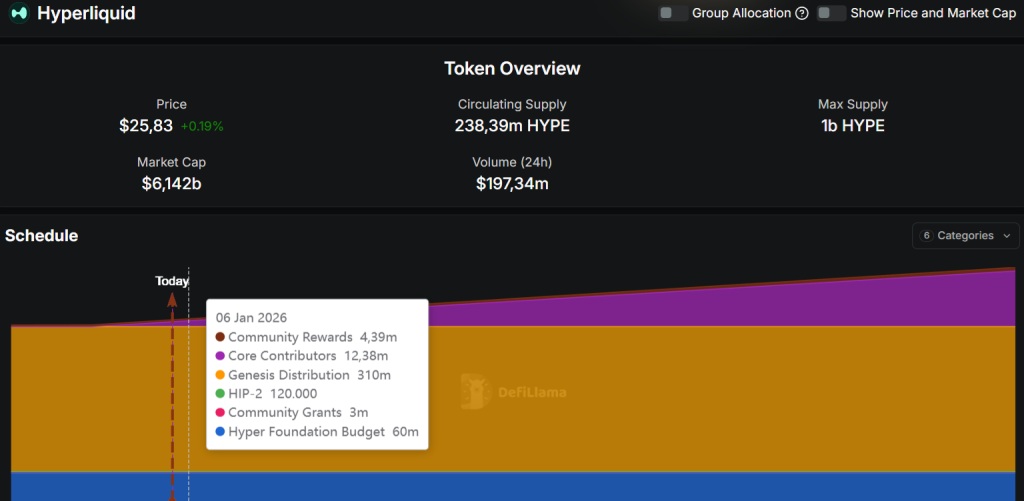

- With a total supply capped at 1 billion tokens and only 238.4 million currently in circulation, the 36-month vesting schedule limits abrupt supply shocks but creates structural price pressure.

Hyperliquid Labs carried out the unstaking of 1.2 million HYPE tokens to start monthly team distributions beginning on January 6. The move marks the formal launch of the vesting program and points to a gradual increase in circulating supply over the coming months.

The unlocked tokens are valued at roughly $31.2 million and belong to a program that allocates around 237 million HYPE to the protocol’s core contributors. As confirmed by co-founder Iliensinc on Discord, distributions will take place monthly on the sixth day of each month. The unstaking was executed specifically to enable these payments, with no additional changes to the protocol’s mechanics.

HYPE Tokenomics

HYPE’s total supply is capped at 1 billion tokens. The current circulating supply stands at approximately 238.4 million, meaning that more than 61% of the total supply remains locked. The vesting structure includes an initial one-year cliff followed by 24 months of gradual unlocks. This design aims to avoid a sudden surge in supply, although it introduces structural pressure over the medium term.

The closest and most significant precedent was the genesis event in November 2024, when Hyperliquid distributed roughly 310 million tokens to early users and community members through an airdrop. Since then, the market has closely monitored each unlock, as these events tend to affect liquidity and trader positioning.

Hyperliquid Proposed a Token Burn Mechanism

HYPE trades around $26, with a market capitalization near $6.2 billion and a fully diluted valuation exceeding $25.1 billion. So far, the token’s price has remained relatively stable despite upcoming unlocks, although selling pressure continues to build as the vesting process advances.

At the same time, the Hyper Foundation proposed a burn mechanism that redirects a portion of trading fee revenue to an inaccessible wallet, permanently removing those tokens from circulation. The initiative seeks to offset the impact of future unlocks on supply.

Hyperliquid remains a key player in the decentralized perpetual futures market, although its dominance is showing signs of erosion as competitors on Ethereum and BNB Chain gain ground.