TL;DR

- KindlyMD has secured an additional $51.5 million through a PIPE funding round, bringing its total raised capital to $763 million, mostly directed toward Bitcoin purchases.

- The firm is proceeding with its merger with Nakamoto Holdings to strengthen its Bitcoin treasury strategy.

- This move places KindlyMD among a growing group of companies adopting Bitcoin as a strategic treasury asset amid strong investor interest and market confidence.

KindlyMD, a Salt Lake City-based healthcare data company, has raised another $51.5 million in private placement financing as it deepens its commitment to Bitcoin as a strategic reserve asset. The funding round, which priced shares at $5.00, was fully subscribed in under 72 hours, showing robust institutional demand. The capital will primarily be used to expand the firm’s Bitcoin holdings and support general operations.

This latest round lifts KindlyMD’s total raised funds to approximately $763 million, including $563 million from PIPE financing and the remainder from convertible notes. The company’s market capitalization stands at about $104 million despite reporting negative EBITDA, reflecting investor confidence in its long-term Bitcoin-focused strategy.

Merger With Nakamoto Holdings Nears Completion

KindlyMD is finalizing its merger with Nakamoto Holdings Inc., a firm dedicated to building a portfolio of Bitcoin-native businesses. This move is set to enhance KindlyMD’s Bitcoin treasury infrastructure. The PIPE financing is expected to close concurrently with the merger, anticipated in Q3 2025. Cohen & Company Capital Markets is acting as lead financial advisor, while Anchorage Digital has been selected as the exclusive custodian of KindlyMD’s Bitcoin assets.

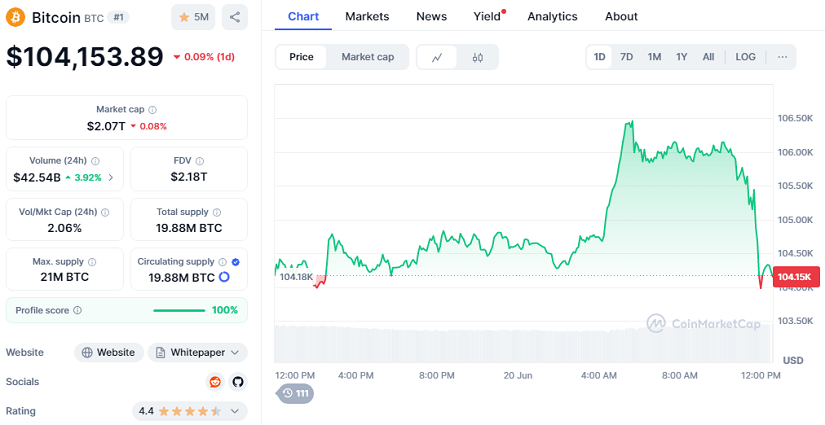

KindlyMD shares (ticker: NAKA) dropped by 7% during early Friday trading, even as the Nasdaq Composite index remained relatively stable. According to InvestingPro, the company maintains a healthy current ratio of 2.3, with sufficient liquidity to cover short-term obligations. Meanwhile, Bitcoin is trading at $104,153.89, showing a slight daily decline of 0.09%, with a total market capitalization of $2.07 trillion.

Restructured Executive Compensation and Warrant Exercise

In preparation for the merger, KindlyMD has adjusted its executive compensation packages. CEO Tim Pickett was granted over 7,400 stock options and nearly 29,000 restricted shares. Other executives and independent directors received similar stock awards. The company also issued over 730,000 shares following warrant exercises, raising more than $4.2 million in fresh capital.

KindlyMD’s strategy continues to mirror moves by other public firms like MicroStrategy, which has famously leveraged capital markets to accumulate Bitcoin. With growing institutional adoption and increasing demand for scarce digital assets, KindlyMD aims to position itself at the forefront of a new financial paradigm.