TL;DR

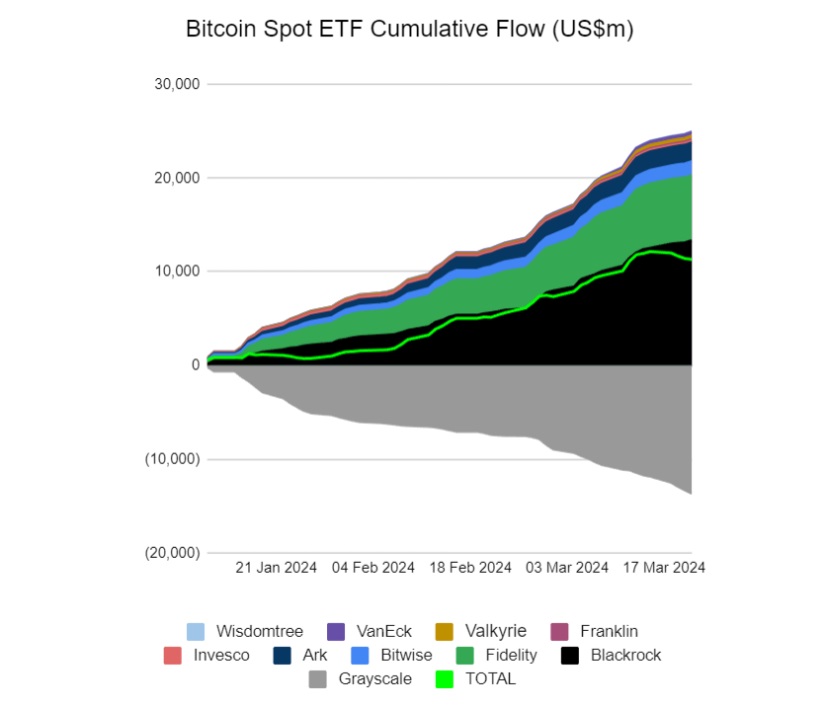

- Fund outflows from Grayscale’s Bitcoin Trust (GBTC) have been significant, reaching nearly $359 million in a single day and $1.8 billion in a week.

- Eric Balchunas, Bloomberg’s senior ETF analyst, suggests that these outflows could be related to crypto company bankruptcies.

- Despite the fund exodus, GBTC still maintains $23.2 billion in assets under management. However, since its conversion to an ETF in January, it has lost $13.6 billion.

The cryptocurrency market has witnessed a series of significant fund outflows from Grayscale’s Bitcoin Trust (GBTC). On a single day, March 21, exits totaled nearly $359 million, adding to a week of high fund outflow activity. In total, $1.8 billion has been withdrawn from GBTC this week, marking the fourth consecutive day of net outflows across the 10 Bitcoin ETFs.

Analysts have speculated about the possible end of these massive fund outflows. Eric Balchunas, Bloomberg’s senior ETF analyst, suggests that much of these outflows could be related to crypto company bankruptcies. Balchunas estimates that once these outflows cease, only retail investors will remain, potentially resulting in a slower fund flow, similar to what was observed in February.

The more I think about it the more likely the uptick in flows is related to the bankruptcies bc of the size and consistency. The flows in Feb showed what retail outflows look like, smaller and random pattern. Also any Gemini/Genisis outflows likely buying btc w cash hence market…

— Eric Balchunas (@EricBalchunas) March 22, 2024

Despite the fund outflows, Grayscale’s Bitcoin Trust still maintains a significant amount of assets under management, totaling $23.2 billion as of March 21. However, since its conversion to an ETF on January 11, the trust has lost $13.6 billion.

Following Balchunas’ line of thought, Genesis, one of these companies, received approval from a US court to liquidate $1.3 billion in GBTC shares to pay off its creditors. On the other hand, FTX, the crypto exchange, sold 22 million GBTC shares, valued at nearly $1 billion, completely liquidating all its holdings.

Grayscale Could Be Approaching its Recovery

ErgoBTC, an independent researcher, suggests that GBTC fund outflows and inflows into Genesis are correlated, indicating a relationship between the two events. This supports the theory that GBTC fund outflows could be primarily driven by crypto company bankruptcies.

On the other hand, Genesis has announced that it will return assets to creditors “in kind,” meaning it will sell GBTC shares for Bitcoin. This payment strategy indicates that GBTC fund outflows are not solely due to market dynamics but are driven by specific events.

Although these fund outflows may be coming to an end, the cryptocurrency market is still expected to remain volatile as these specific events are resolved.